Yahoo is squarely in our sights this week. From Seeking Alpha:

‘On Friday, news broke that Berkshire Hathaway Chairman Warren Buffett is backing a consortium that includes Quicken Loans founder Dan Gilbert in a bid for Yahoo.

A successful bid would be a relatively rare journey into digital media for Buffett. But Rick Edmonds of Poynter Institute says Buffett’s history of betting on struggling companies that wield a large user base could work in Yahoo’s favor. “It’s kind of consistent with Buffett’s pattern of buying things that are out of favor, undervalued and have a big customer base,” he says. “The paradox is Yahoo’s huge, it remains huge, and it’s got a lot of customers. It’s not the case customers are fleeing them right and left, it’s just that no one can get a good pattern of growth.”

Note that former Yahoo president and CFO Susan Decker is now a director at Berkshire. Last month she said Yahoo’s next owner should “create a distinction in consumers’ minds about why they love Yahoo still” and that doing so would be better if Yahoo is “private or part of a much larger corporation.” It’s possible that with Decker’s input, Buffett would look to rehire former Yahoo executives such as Ross Levinsohn.”

So there you go. Buffett and his friends are going to try and buy Yahoo. How does one play this as an options trader? The first thing you have to come to terms with is that you have no idea if this deal is going to go through. Anyone with an internet connection can get the same information and make themselves feel like they know what’s going on in these meeting.

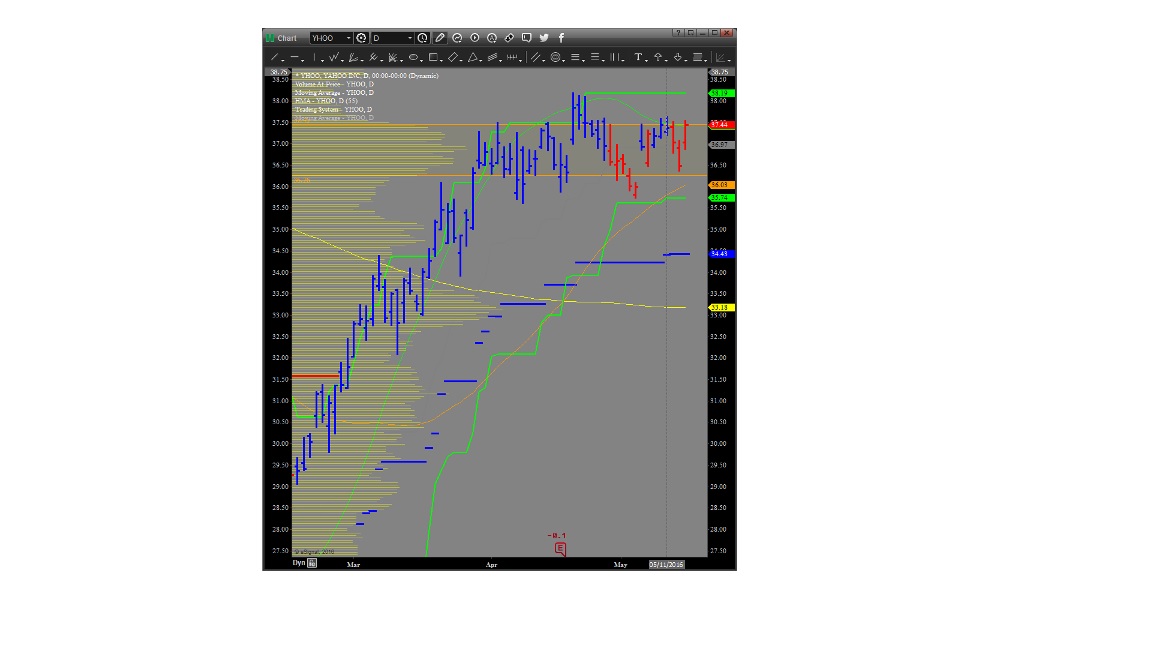

So with the position that we don’t know what’s going to happen, we must take the position that we can only surmise what is NOT GOING TO HAPPEN. I think one of two things happens. One, the deal does go through and then Yahoo goes up. Two, the deal falls apart and then market forces that existed before take hold. Take a look at the chart:

I propose this signal:

Sell (opening) the June YHOO 35 put

Buy (opening) the June YHOO 33 put

For a CREDIT of $0.50 or more

What happens given my two contingencies? One, the deal goes through, YHOO rallies and we keep our entire credit. Two, the deal falls apart. You can see on the above chart that before this deal was proposed there was firm support from the high volume area (orange shaded area) and then just below around the $35.75 – $36.00 from the bottom of the Donchian Channel. If this area holds we still keep our entire credit. Of course, there is no guarantee that this level holds so what is our risk? Our max risk is if we are below $33.00 at expiration. In this case, we lose $1.00 on the options but we do have our initial credit of $0.50 so our net loss is $0.50 or $50.00 per options contract sold.