Hey Gang, sorry this is a bit late getting out. I know many of you are religious about archiving these — which is precisely their purpose — so here it is in shortened form. Early February was all about fear of a sovereign debt domino effect on the prospect of a default by Greece.

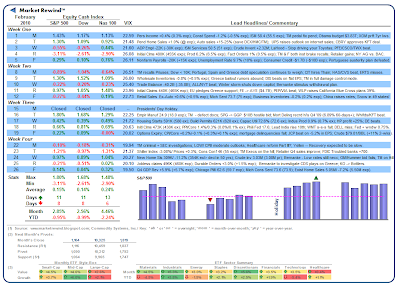

However, by the end of the month after clean tag of the S&P 500’s 200-day ema, a significant snap back rally ensued that has pushed well into mid-March. This move left the S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices higher across the board by +2.85%, +2.56% and +4.46%, respectively. With ramifications of the exchange of private for public debt put on the side for now, equities continue to string together a record ratio of up days. Will this year-old bull market ever turn “gray” — or was the pause that refreshes just the “formula” we needed to continue higher?

Sentiment: Positive

Volatility: Low (VIX 19-27)

Direction: Mixed to Positive

[Click to Enlarge/ Weekly ETF Analyses/ Prior Monthly Summaries]

[Click to Enlarge/ Weekly ETF Analyses/ Prior Monthly Summaries]The Style-Box was calculated using the following PowerShares™ ETFs: Small-Growth (PWT), Small-Value (PWY), Mid-Growth (PWJ), Mid-Value (PWP), Large-Growth (PWB), and Large-Value (PWV). The Sector-Ribbon was calculated using the following Select Sector SPDR™ ETFs: Materials (XLB), Industrials (XLI), Energy (XLE), Staples (XLP), Discretionary (XLY), Financials (XLF), Technology (XLK), and Healthcare (XLV). The Standard & Poors 500, Dow Jones Industrial Average and NASDAQ 100 may be traded through ETF proxies, including the SPY or IVV, DIA and QQQQ, respectively.