OPTION TRADE OF THE DAY!

3-8-2010

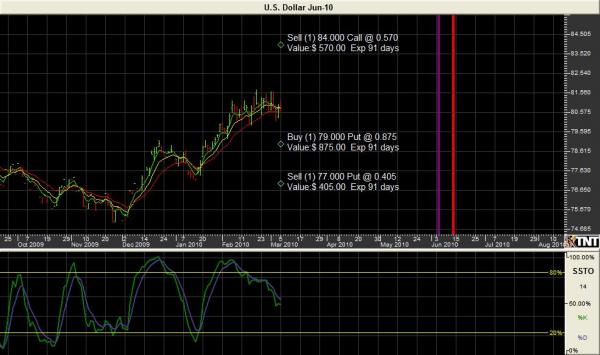

June Dollar Index appears to have reached an exhaustion point in its rally, we are shorting the market using a June 79/77 bear put spread with a naked 84 call. The trade is 10 under 10 over meaning that it’s a debit of $100 for the spread which would be your risk with the market under 84, above 84 there is unlimited risk. The Profit potential is limited to $2,000 as well.

See chart below

Please contact us with any questions or if you would like assistance with placing this trade.

See attached chart

Paul Brittain

Whitehall Investment Management of Las Vegas

There is a substantial risk of loss in trading futures and options

Past performance is not indicative of future results.

The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

FOR CUSTOMERS TRADING OPTIONS, THESE FUTURES CHARTS ARE PRESENTED FOR INFORMATIONAL PURPOSES ONLY. THEY AREINTENDED TO SHOW HOW INVESTING IN OPTIONS CAN DEPEND ON THE UNDERLYING FUTURES PRICES; SPECIFICALLY, WHETHER OR NOT AN OPTION PURCHASER IS BUYING AN IN-THE-MONEY, AT-THE-MONEY,OR OUT-OF-THE-MONEY OPTION. FURTHERMORE, THE PURCHASERWILL BE ABLE TO DETERMINE WHETHER OR NOT TO EXERCISE HISRIGHT ON AN OPTION DEPENDING ON HOW THE OPTION’S STRIKEPRICE COMPARES TO THE UNDERLYING FUTURE’S PRICE. THE FUTURES CHARTS ARE NOT INTENDED TO IMPLY THAT OPTION PRICESMOVE IN TANDEM WITH FUTURES PRICES. IN FACT, OPTION PRICES MAY ONLY MOVE A FRACTION OF THE PRICE MOVE IN THE UNDERLYINGFUTURES. IN SOME CASES, THE OPTION MAY NOT MOVE AT ALL OR EVEN MOVE IN THE OPPOSITE DIRECTION OF THE UNDERLYING FUTURES CONTRACT.

Paul Brittain

Whitehall Investment Management Las Vegas

Email: paul@binvstgrp.com

Phone 877 270 8403, 702 463 0718

Paul Brittain

Commodity Trading School

877-270-8403

702-463-0718

info@commoditytradingschool.com

paul@binvstgrp.com