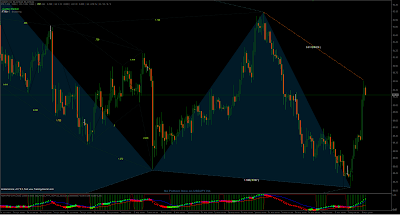

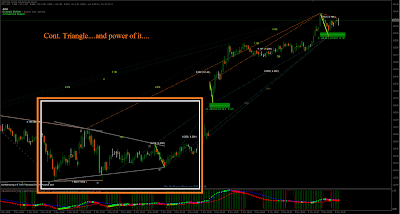

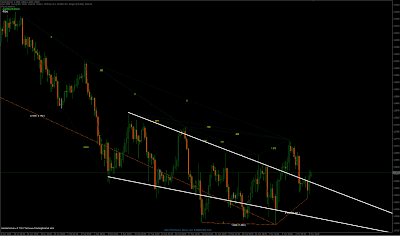

Perhaps this pattern starts to be somewhat ready, it does have 9 boundary touches now. One breake allready, re-test with some kind of failure with line, but because it is eurodollar it is never going to give anything too easy. Should be on the way to test 38.2% at least from this reasonable big drop which tested daily chart 61.8% retracement 3 times before market started to respond for any reversal calls. Usd-Jpy have also 240 min bullish gartley position indicating yen crosses bottom has been placed. For the reason or another I don´t like this pattern in here, the movement inside of the pattern are not something I had used to see with diagonals but there is no perfect world with eurodollar. SPX had yesterday contracting triangle and market responded for that. Next week is going to be interesting because this price should not subdive anymore inside to the pattern, it should start taking larger ABC corrective upmovement at least or then impulsive like SPX does. Additonally have to attatch this cont. triangle chart, it is beauty. It prints first one as wrong because B wave of cource have to have previous impulse wave behind of it but second one is beauty. It needs slightly more brainwork how to close those odd versions off where it takes entire chart to build it as one triangle. Attatched also usd–jpy gartley, it is reasonable good pattern, but also needs manual check. Harmony approach is generally too cosmetic approach since it does not check what´s inside of those triangles at all by wave point of view. It is looking them only as outside projections.

Uncategorized