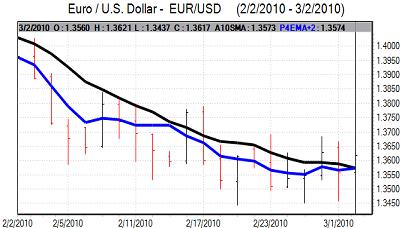

EUR/USD

The Euro hit resistance above 1.3550 in early European trading on Tuesday and again dipped sharply ahead of the US open as a break of support near 1.35 triggered stop-loss selling. The Euro dipped to a low just below the 1.3450 which was a fresh 10-month low. There was no follow-through selling after the break of support and the Euro recovered ground quickly as the dollar lost momentum.

The Greek government announced that it would announce fresh fiscal measures on Wednesday which helped boost confidence that the crisis could ease. There was a significant narrowing of credit default swaps during the day which suggests that underlying market tensions had eased. The flash Euro-zone inflation estimate dipped to 0.9%, for February but this did not have a significant impact.

There were no significant US economic data releases during the day, but there will be important releases on Wednesday. The ADP employment report will have a significant impact on expectations surrounding Friday’s employment report while the services-sector ISM report will also be an important indicator of demand outside the manufacturing sector.

The Euro maintained a firmer tone over the remainder of Tuesday and retested levels above 1.36 during the US session as the dollar was generally weaker.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The domestic economic data recorded a larger than expected decline in unemployment to 4.9% from a revised 5.2% while consumer spending was slightly weaker than expected.

The dollar was unable to push above the 89.50 level during Tuesday and edged lower to re-test support levels during New York trading with a low just above 88.50.

Fears surrounding the Euro-zone sector eased slightly during the day which also tended to curb demand for the yen on defensive grounds and the Euro found further support below 120 against the Japanese currency.

Sterling

Sterling was unable to regain the 1.50 level against the dollar during Tuesday, but it was also able to resist a further test of support below 1.48 as there was an underlying tone of consolidation following sharp losses the previous session. Underlying sentiment remained weak, but a substantial amount of bad news had already been priced in.

The construction PMI index remained below the 50 level which maintained unease over the building sector, but the release did not have a substantial impact and there was a slightly more optimistic tone in the survey.

There will be uncertainty ahead of Thursday’s Bank of England interest rate decision, especially as recent comments from Bank of England officials has suggested a wide range of views within the MPC

Markets will be expected policy to be unchanged, but there will be some speculation over further quantitative easing which will tend to keep Sterling on the defensive ahead of the announcement.

Sterling edged back toward the 1.50 level later in the US session while the UK weakened back towards 0.91 against the Euro.

Swiss franc

The dollar pushed to a high near 1.0890 against the franc on Tuesday, but was unable to sustain the advance and weakened back to below 1.08 later in the session. The Euro strengthened to just above the 1.4650 level against the franc which prompted some speculation that the National Bank was intervening in the market again.

The latest Swiss GDP data was also stronger than expected with a 0.7% expansion for the fourth quarter of 2009 after a revised 0.5% increase the previous quarter and this will tend to maintain expectations that the Swiss economy will out-perform the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

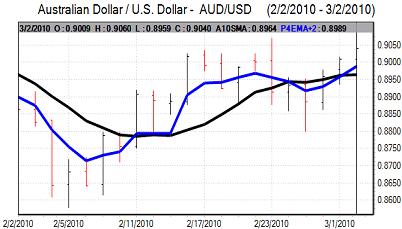

Australian dollar

The Reserve Bank of Australia increased rates to 4.00% at the latest policy meeting, as expected, but the Australian dollar was unable to sustain an initial advance and dipped back towards 0.8950 before finding support during European trade.

A generally weaker US currency allowed fresh gains for the Australian dollar later in the US session and it pushed to a peak just above 0.9050 with a firm tone for the Canadian dollar also providing some support.