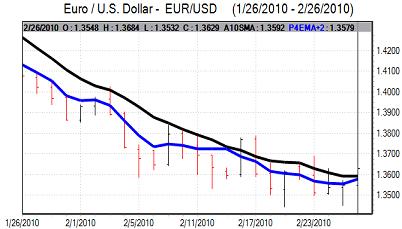

EUR/USD

The Euro found support below 1.3550 during Friday and maintained a firmer tone during the day. The Euro spiked higher to a peak around 1.3680 late in the US session before dipping back slightly. The heavy speculative positioning in favour of the dollar will maintain the risk of sharp dollar corrections.

The US data was mixed and may have undermined the dollar slightly, although position adjustment was probably a key factor ahead of the weekend.

The fourth-quarter US GDP estimate was revised up show an annualised expansion of 5.9% from the previous 5.7% estimate. The Chicago PMI data was also higher than expected at 62.6 for the month.

In contrast, there was a weaker than expected reading for the Michigan consumer confidence data while there was also a decline in existing home sales. The consumer and housing-related data will tend to increase fears that the consumer sector will not be able to sustain growth and the more forward-looking data will cause some unease. The yield spread between US and German benchmark bonds is still at the widest level in favour of the dollar for over two years which should continue to provide some degree of support for the US dollar.

The Euro’s ability to withstand further losses will lead to some speculation that a near-term bottom for the currency has been seen. Euro fears may also have eased slightly, although there are still very important stresses with German Chancellor Merkel, for example, stating that the Euro was in its most difficult phase. In this environment, Euro sentiment is liable to remain weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen was able to maintain a firmer tone against the dollar during Friday with the dollar dipping to test renewed support below the 89 level later in the US session. The Euro found support close to the 120 level against the Japanese currency

The dollar was unsettled by the weaker than expected housing data which maintained the run of generally weaker data surrounding the consumer sector.

There is a general lack of confidence in the Euro while there is unease over the US fundamentals which is continuing to lessen the potential for Japanese currency selling. Unease over deflation trends in Japan continued to curb yen buying to some extent.

Sterling

Sterling pushed higher in an immediate reaction to the revised GDP data, but failed to sustain the advance and was generally subjected to substantial selling pressure during the day. The currency dipped to a fresh nine-month low against the dollar with a low point close to 1.52 before a recovery back above 1.52 later in the US session. The trade-weighted index also weakened to a four-month low during the day.

The fourth-quarter GDP estimate was revised up to show an annual figure of 0.3% from the 0.1% figure released earlier. The annual contraction was slightly larger as the third-quarter data was revised lower. There were also fears that the growth secured in the fourth quarter had effectively been brought forward from 2010 and that this could help trigger a weak reading for the first quarter.

Underlying confidence in the economy remained weak, especially as the latest opinion polls continued to suggest the risk of an decisive election result. There was also speculation that the prudential Group could buy AIG’s Asian operations which could involve heavy Sterling selling. The currency is, however, over-sold on a short-term basis which may provide some near-term relief.

Swiss franc

The dollar was unable to re-test resistance levels above 1.08 during Friday and dipped sharply to lows near 1.07 later in the US session as there was a wider, sharp corrective dip in the US currency. Despite an improvement in the Euro against the dollar, the Euro was unable to make any headway against the franc.

There was a firm reading for the KOF index which will provide some degree of support for the franc on optimism over the economy.

Underlying stresses in the Euro-zone economy should continue to provide some degree of support for the franc on defensive grounds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

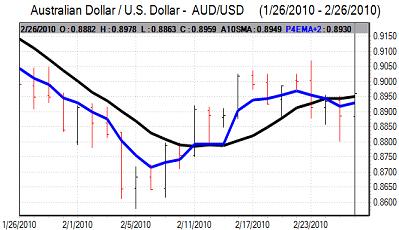

Australian dollar

The Australian dollar found resistance close to the 0.89 level against the US currency for much of Friday, but pushed higher later in the US session as the US currency was subjected to wider selling pressure in the markets.

There was further speculation over an interest rate increase at the early-March Reserve Bank meeting which continued to provide some degree of support for the Australian currency.