Feb. 25 (Bloomberg) — Greece’s debt rating may be cut within a month as it struggles to pare the European Union’s largest budget deficit, driving up borrowing costs and renewing pressure on the euro.

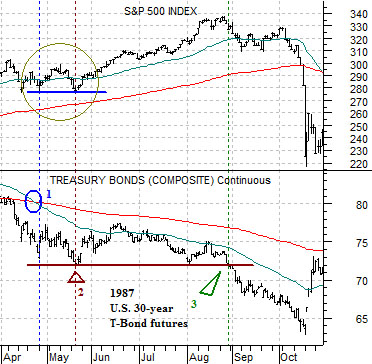

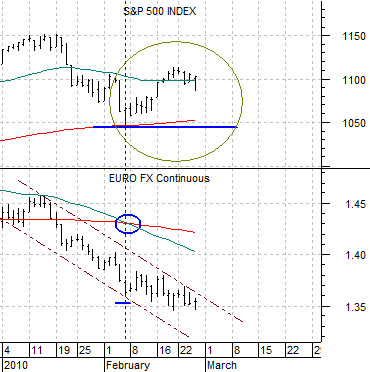

We are going to return to a chart-based argument that we have been featuring on occasion over the past few weeks. The idea is that the S&P 500 Index (SPX) is reacting to downward pressure on the euro in a manner similar to the way it responded to the bond market back in 1987. The good news is that once the bonds found support in May of 1987 the stock market rallied on to new highs. The bad news, of course, would be the ‘crash’ that took place a few months later.

Below we compare the SPX with the U.S. 30-year T-Bond futures from April through October of 1987.

There are three distinct points on the chart that we have been fixating over. The first took place around the time that the 50-day exponential moving average line (e.m.a.) crossed down through the 200-day. The second represents the low point for the TBonds in late May of 1987 while the third is the break below that low towards the end of August.

We argued a few weeks back that if the SPX were following a similar path in 2009 that we should see some kind of bounce for equities once the 50-day e.m.a. line for the euro crossed down through the 200-day. The chart at bottom right contains this comparison.

If the SPX rallied as the moving average lines crossed then the next low was expected to occur once the euro found some kind of semi-sustainable bottom. In other words once the euro reached a point that the markets were prepared to defend for a few months the equity markets would kick back into gear to the upside.

Our view has been that the SPX is currently in a similar position to May of 1987. The moving average lines have crossed but through trading yesterday the markets have not reacted in a manner that would suggest that the euro has found a bottom. Whether the SPX retraces the rally up from 1050 is still open to debate but our thought is that one way to tell that the euro has reached support should be through stock markets strength. If the SPX blasts up through 1112 then the correction is over with the euro setting support at the 1.35 level.

Equity/Bond Markets

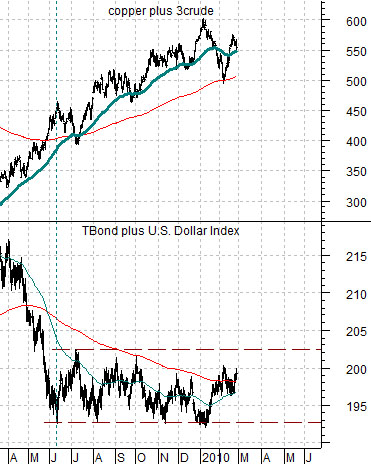

What should you expect from the markets when the dollar AND the bond market start to rise at the same time? Generally… downward pressure on energy and base metals prices.

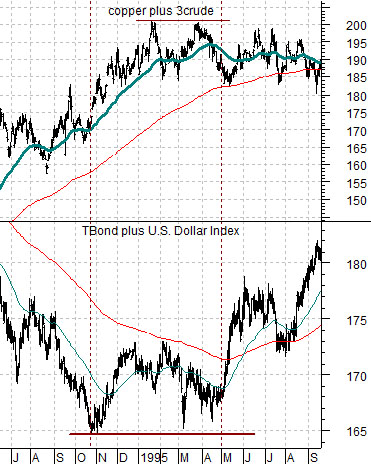

We have done this one on many occasions over the years but this is probably a good time to make the point once again. To explain we show a chart comparison of the sum of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY) and the sum of copper (in cents) and crude oil (in dollars times three) from 1994- 95.

The argument is that when the TBonds and dollar are declining the trend for copper and crude oil is strong and rising. On the other hand when the dollar and bonds flatten out and then turn higher the trend for energy and metals prices starts to weaken.

The key, by the way, is what ‘weaken’ means. If the dollar and bond market continue to rise (notice that the sum has moved above the 200-day e.m.a. line on the chart below right which is similar to the comparison in May of 1995) and copper and crude oil prices collapse… then the stock market will stumble. If, on the other hand, the combination of oil and copper prices merely flatten out (like 1995) then the stock market will do quite nicely.

Our sense is that the markets fear that dollar strength will crater the commodity markets and have long forgotten that this exact set up can create powerful equity bull markets. The lesson from 1995 was that flat commodity prices combined with falling interest rates represent a very positive outcome.

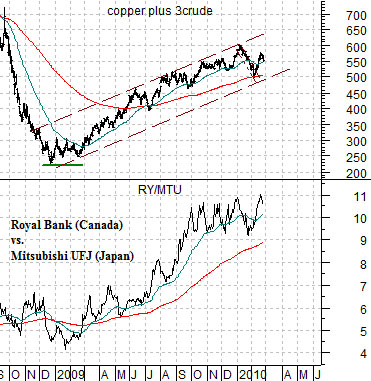

Below we show the sum of copper and crude oil along with the ratio between the share price of Canada’s largest bank (Royal Bank- RY) and Japan’s largest bank (Mitsubishi UFJ- MTU). The argument is that Cdn banks do much better than Japanese banks when energy and metals prices are trending higher. If the sum of copper and crude oil flattens out or declines then we would expect to see some better price action in the days ahead from MTU.