EUR/USD

The Euro consolidated in a 1.3520-1.3550 range against the dollar for much of Wednesday ahead of Fed Chairman Bernanke’s testimony to the House of Representatives.

The Fed Chief stated that economic conditions were improving and that deterioration in the labour market was also easing. There were also comments that the Fed would eventually need to tighten policy as the recovery improves. Nevertheless, Bernanke retained his comment that interest rates would need to stay at exceptionally low levels for an extended period and there was no suggestion of a near-term policy tightening. In response, futures markets cut the chances of a Fed funds hike by November to around 50%, although much of the adjustment had already taken place.

There was also a weak reading for US new home sales with an 11.3% monthly decline to a record low. In response, the Euro strengthened to above the 1.36 level against the dollar with some additional support suspected from central banks while the Euro-zone industrial orders data was also stronger than expected.

The Euro was unable to sustain the advance and weakened sharply to test support levels below 1.35 in early Asian trading on Thursday. Underlying confidence in the Euro-zone remains extremely fragile as labour protests continue in Greece while there has also been additional unease over the situation in Spain which is continuing to limit the scope for any Euro recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below the 90 level during Wednesday, but was unable to make significant upward progress as underlying support remained subdued.

Bernanke’s generally dovish comments on the US economy and interest rate outlook curbed dollar support on yield grounds and this will remain an important factor in curbing near-term dollar demand.

Markets struggled to find a decisive trend on risk appetite which tended to dampen yen activity, but the dollar dipped back below the 90 level in Asian trading on Thursday with significant yen buying support on the crosses also tending to keep the dollar on the defensive.

Sterling

Sterling held above 1.54 against the dollar on Wednesday, but was unable to break above 1.55 as underlying confidence remained weak.

The outlook for monetary policy remained a key focus and Bank of England MPC member Posen made similar comments on Wednesday to those of Governor King the previous day in stating that the bank would expand quantitative easing if necessary. The comments reinforced expectations that the UK will maintain a highly-expansionary monetary policy for longer than the other G7 countries which reinforced negative Sterling sentiment.

Underlying confidence is also still being undermined by fears over government debt and the political stresses over the next two months which will divert attention away from measures to curb the deficit.

Sterling retreated to test support levels below 1.54 against the dollar in Asian trading on Thursday with significant selling pressure on the crosses as the Euro looked to hold above the 0.88 level.

Swiss franc

The dollar consolidated above 1.08 against the Swiss franc for much of Wednesday before dipping sharply lower to near 1.0750 following Bernanke’s testimony. The franc, in turn was unable to sustain the gains and the dollar pushed back to 1.0850 on Thursday as markets probed resistance levels.

The Euro was again under pressure during the day as underlying confidence in the region remained weak and it edged back to near the 1.46 level.

Markets will remain on high alert over potential intervention, especially as the Euro rebounded strongly last week from near the 1.46 region, but the Euro will find it much more difficult to gain sustained support.

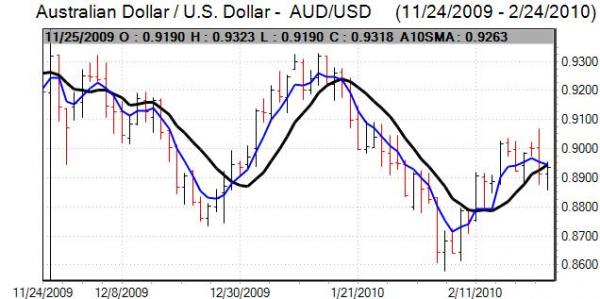

Australian dollar

The Australian dollar found support on dips towards the 0.8850 level against the US dollar on Wednesday and generally consolidated above 0.89 following heavy losses over the previous 24 hours.

There was a firm reading for capital spending which helped boost confidence in the Australian currency and there is still evidence of buying support on dips. Volatility is still likely to be a key feature with unease over the global economic trends.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here