Although it is not easy to trade China’s capital markets from outside of China, some traders have taken to using Australian stocks as a proxy. On weekly and monthly time frames, short positions have done well since early 2014. Here we examine the decline in the iShares MSCI Australia ETF (symbol EWA), the holdings of which include shares of 78 large and mid-sized companies in Australia.

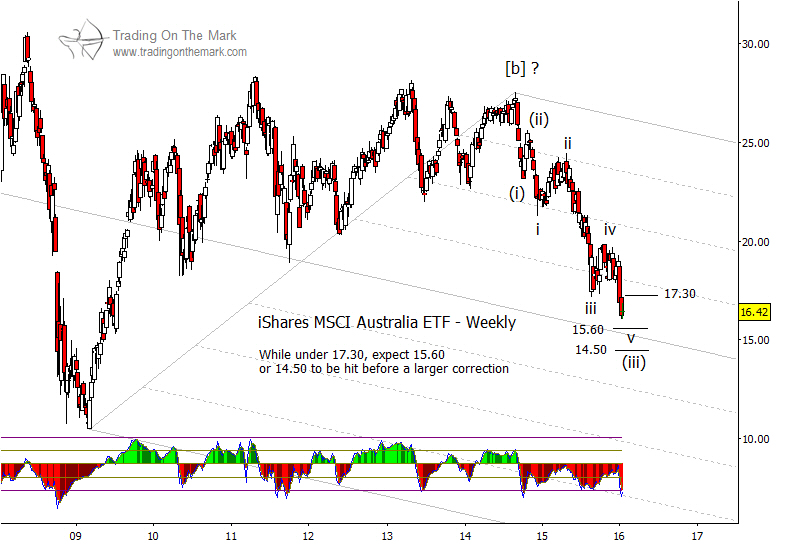

On the weekly chart below, the Elliott wave structure suggests that the fund should decline a bit farther in downward wave (iii) of what should eventually become a five-wave (i)-(ii)-(iii)-(iv)-(v) sequence. The large Schiff channel drawn on the chart implies that mid-channel support should appear in the general vicinity of 15.00, depending on time. There also are Fibonacci-related targets/supports at 15.60 and 14.50, either of which could represent the completion of wave (iii).

While monitoring the decline into support, watch the 17.30 area as potential resistance for a small internal correction within sub-wave ‘v’ of (iii). During the next few weeks, that could provide a basis for fast short trades if the level is tested from below. However, most traders will be watching the charts with larger moves in mind, such as a potential fourth-wave bounce or correction that could begin during the next few months. That development might represent an opportunity to take profits from short positions or even to try a carefully planned long entry from support.

Although it is too early to predict the timing, eventually there should be another sizable shorting opportunity for EWA near the completion of corrective wave (iv). Since fourth waves can take a variety of forms, we will continue to watch the weekly and monthly charts for clues about when that opportunity might appear.

As an aside, the Australian index has been declining in earnest for a longer time than U.S. and European indices have. From that perspective, the magnitude of the decline may foreshadow developments in the S&P 500, the Dow and the DAX during approximately the next two years.