EUR/USD

The Euro remained generally fragile ahead of the US employment data on Friday, but did find some support below the 1.3650 level against the dollar as there was caution over further aggressive selling.

The headline US payroll data was slightly weaker than expected with a decline of 20,000 for the month while December’s decline was revised to 150,000 while there was a downward adjustment in the annual benchmark revision. In contrast, the reported unemployment rate declined to 9.7% from 10.0% which was the lowest rate since August, although there will be doubts over the reliability of the survey and it is also the case that the workforce declined considerably over the month. There will be some optimism surrounding an increase in manufacturing jobs, but the net implications remain a weak labour market and interest rate expectations are unlikely to shift significantly.

The data release was overshadowed to some extent by fears over the Euro-zone outlook as confidence in the debt situation remains very weak. G7 members failed to provide significant reassurance during talks over the weekend and, indeed, there was some evidence that confidence was deteriorating further with fears that tensions would intensify in countries such as Portugal, Ireland and Spain.

The Euro pushed back above 1.37 following the payroll data, but failed to hold the gains and dipped to test 8-month lows later in the US session. The Euro remained generally under pressure on Monday as sentiment remained depressed with a dip to below the 1.36 level as Euro debt fears dominated.

The latest IMM data recorded an increase in short Euro positions to a record high and this may make it more difficult for markets to extend the downward Euro move.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was volatile following the US employment release on Friday and hit tough resistance close to the 90 level with an underlying consolidation in the 89.50 region. Risk appetite attempted to recover late in the US session in line with a rebound in US equity markets and this curbed yen demand to some extent.

The underlying mood is still one of caution with Asian stock markets generally weaker on Monday amid fears over the global economic outlook and sovereign debt ratings. In this environment, there is unlikely to be heavy selling pressure on the Japanese currency with some significant safe-haven demand realistic.

Domestically, the bank lending data was weak and this will tend to reinforce fears over the domestic economy which will also tend to curb underlying yen demand. The dollar found support below the 89 level on Monday and pushed back to the 89.25 region.

Sterling

Sterling found support on dips towards 1.5650 against the dollar ahead of the US employment data on Friday and rebounded to above 1.57. The UK currency was unable to sustain the gains and remained under pressure in Asian trading on Monday with lows below the 1.56 level.

There were no significant UK data releases during the day with markets tending to focus on debt issues. There was a warning from a former IMF economist that the UK faced a debt crisis and it is the case that increased fears surrounding sovereign debt ratings would tend to undermine Sterling given the underlying debt vulnerabilities.

The political situation also remains important and further opinion polls suggesting the possibility of an uncertain election outcome later in 2010 also tended to put downward pressure on the UK currency.

Swiss franc

The dollar was able to maintain a generally firm tone against the Swiss franc on Friday, but was unable to make a significant challenge on resistance near the 1.08 level. After a sharp spike early in the Asian session, the Euro was unable to sustain the advance and weakened back to below the 1.47 level as risk appetite remained generally fragile.

The Swiss currency will tend to secure further defensive support while confidence in the Euro-zone debt situation remains weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

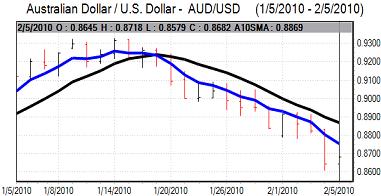

Australian dollar

The Australian dollar rallied to above the 0.87 level following the US payroll data on Friday, but was unable to sustain the advance and weakened back to below the 0.86 level in early trading in Asia as sentiment remained weak.

Risk appetite remains generally fragile and there are continuing fears surrounding the outlook for commodity prices, especially with speculation over a further tightening of monetary policy by China, and this remains an important negative factor for the Australian currency.