It’s time to bid farewell to biotech. The sector is finally succumbing to the inevitable. I consider a bear market in biotech ‘inevitable’ because a glance at the chart of the main biotech ETF (IBB) shows a parabolic 5-year advance. Such exuberance always leads to equally steep corrections.

As noted last week, although the biotech ETF has a market cap of only $8 billion, the market cap of its top 10 holdings, which represent 60% of total assets, is $600 billion. Consequently, biotech is now a $1 trillion albatross on the neck of the Nasdaq.

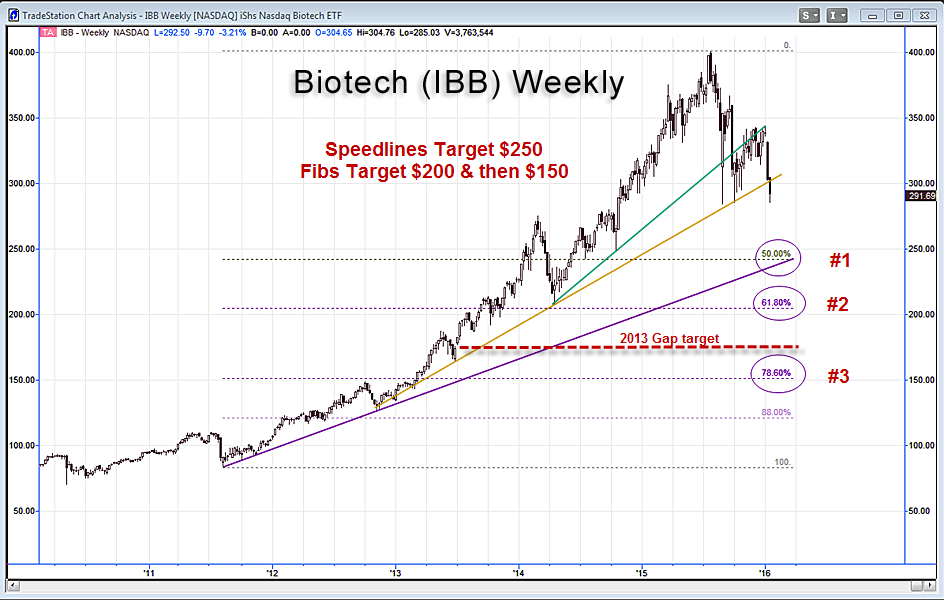

The accompanying chart shows a series of three trendlines, called speedlines. There are stops (sell orders) at each of these three levels and two have already broken like the rungs of a weak ladder. The third speedline is my initial target at the 50% retracement of the heady biotech bull, a bit below $250.

I expect a much deeper decline, however, because having traded through a number of bear markets, I’m familiar with the standard gap-fill process that occurs during major corrections. IBB has an unfilled gap from July 2013 between $175 and $177. This is large enough to get noticed, logged and targeted by the gap fill posse.

Since markets fall much faster than they rise, the bear market in biotech should be complete within 12-18 months, reaching a final downside target at $150. The Nasdaq is likely to correct in a similar manner during this period.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)