By: Scott Redler

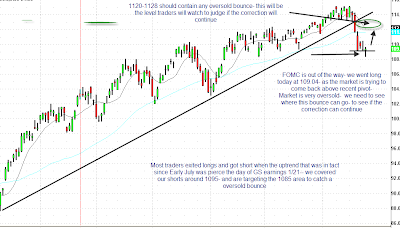

Yesterday we came in with a plan to get long. We bought the SPY on a reversal pattern and entered some financials long. The question now is: HOW MUCH CAN WE BOUNCE? There is a small level of resistance in the 1,104-1,107 area on the S&Ps and a WALL of resistance in the 1,120-1,125 area.

- Google (GOOG) was a good long against the $535 level. Now it will be interesting to see if it can break above the 4-day pivot of $548-550. If so, then it has room to get to $565.

- Baidu (BIDU) held some of its news gap and the 100-day moving average. It still looks pretty good.

- Apple (AAPL) survived its “NEWS EVENT OF THE CENTURY” and impressively did not succumb to the “sell the news” phenomenon. Now it needs some time to consolidate this upper range between $198-215 area with an inside range of $204-210.

- Research in Motion (RIMM) has been a good long the last two days and will be testing its descending trendline at around $65.50.

- Amazon’s (AMZN) squeeze is on after a big decline. They report earnings today after the close. I would be careful.

- Microsoft (MSFT) also reports after the close. I do think this report will be STRONG. For those who speculate, you can be long into earnings. If you can hold it, you can probably trade out of it without too much pain over the coming months if you don’t get the report you want.

- SanDisk (SNDK) reports after the bell today. The way it’s trading suggests that a BIG UP MOVE may be in the cards–much like we had in Cree (CREE) and VMWare (VMW).

- The banks finally bounced–I am long Goldman Sachs (GS), JP Morgan (JPM) and the XLF against yesterday’s lows. The FAS could get up to the $77-79 area before it hits some big resistance. Take a look at the chart of JP Morgan below for a visual of the trade setup.

- MGM held up GREAT during this decline–excellent relative strength compared to Wynn Resorts (WYNN) and Las Vegas Sands (LVS). I would look to see if it can get going above $12.30-12.50.

- The OIH and USO have similar room to the S&P.

- U.S. Steel (X) and Freeport McMoran (FCX) have both been badly beaten since their respective earnings reports. Both are up a bit this morning and have some room to the upside.

.png)

.png)