Wednesday delivered a nice day for the bulls despite the slow choppy market we experienced for three hours. Volume was heavier on the NYSE and Nasdaq, leaving an accumulation day. On the 13th we had a mixed day of volume for a partial accumulation day and the 7th was also a partial day leaving the only other accumulation days this year on the 4th with today’s win. It is really unusual given the number of up days we’ve had to have so little participation in the market. Seeing this participation today, we need it to continue or it’s a one and done deal. The TRIN closed at .71 bullish and the VIX at 23.14 about 8.3% off the 10dma. Gold closed down $13.80 to $1084.50 and oil down $1.07 to $73.64.

If you’ve read all week you know I was alarmed on Monday with that VIX off the 10dma by 21%, now we are 8.3% off that is a huge move in a short period of time. We like to be around that 10% mark, so this side maybe overdone a little now. I expect that volatility to continue for us though as we close the month out. The TRIN along with the U/D and A/D have been in line all week with the action we’ve seen which is certainly better and that is due in part to the volume increase we’ve seen.

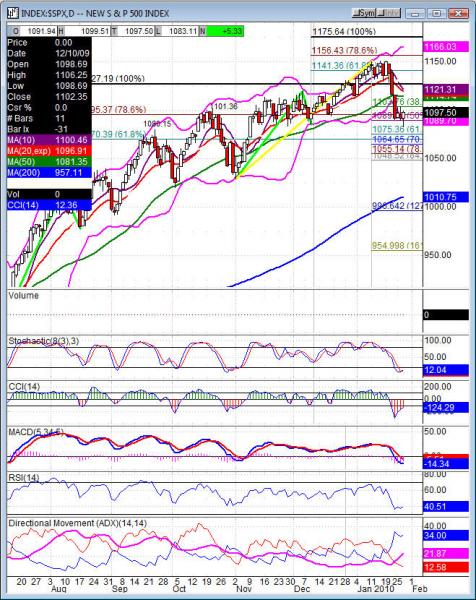

Last night I discussed three days for a flag, we put in that third day today. That doesn’t mean we will move, a flag can be 3-7 bars, that would be 3-7 days on a daily chart. Technically it can be more than that, but for me I think that gets too long in the tooth to like it for a primary pattern to watch. It may become an undertone for me then, but not a primary. The market still sets under the 50dma on each index leaving us still under a key resistance and with a possible bearish pattern forming. Through the weeks low would trigger this pattern for another leg down. The move into -100 line on the CCI came for us today, rejection there is likely to be the first hint of the flag to trigger the pattern and put things in motion.

For the upside a move back through 38.2% of this drop would certainly put that flag to rest and make this consolidation a floor of support to pivot off of and continue the upside. The market still sets over the prior swing lows which keeps the uptrend still intact. Which leaves us to not write the bulls off and todays accumulation day has the opportunity to swing that upside door open.

Economic data for the week (underlined means more likely to be a mkt mover): Thursday 8:30 Core Durable Goods Orders, 8:30 Unemployment Claims, 8:30 Durable Goods Orders, 10:30 Natural Gas Storage. Friday 8:30 Advance GDP, 8:30 Advance GDP Price Index, 8:30 Employment Cost Index, 9:45 Chicago PMI, 9:55 Revised UoM Consumer Sentiment, 9:55 Revised UoM Inflation Expectations.

Some earnings for the week (keep in mind companies can change last minute: Thursday pre market MMM, ALK, MO, T, CP, CAH, CL, LLY, F, JBHT, JBLU, LLL, LMT, MOT, NOK, OXY, OSTK, POT, PG, TYC, UA, LCC, ZMH, and after the bell AMZN, AMCC, CA, DLLR, JNPR, KLAC, LSCC, MXIM, MSFT, PMCS, RMBS, SNDK, VSEA, YRCW. Friday pre market CVX, FO, HON, MAT, NS, and nothing after the bell.

SPX (S&P 500) closed +5.33 at 1097.50. Support: 1089.56, 1064.65, 1055.14, 1029.38. Resistance: 1113, 1127.10, 1137.14, 1150.45.