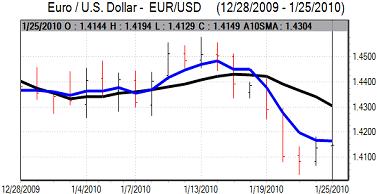

EUR/USD

The dollar remained slightly weaker in early Europe on Monday with greater confidence that Bernanke would be confirmed helping to improve risk appetite and this gave some support to the Euro. There was still a mixed impact on the dollar as confirmation of Bernanke would tend to support confidence in US markets.

Developments surrounding Bernanke’s position will continue to be watched closely in the short term. Senate leaders are aiming to hold a vote this week. There will also be some speculation that there will be an informal pact for Bernanke to pledge low interest rates in return for supporting his nomination.

This speculation will be particularly important given that the latest FOMC meting will announce its interest rate decision on Wednesday. The uncertainty surrounding Bernanke will tend to lessen expectations of firmer rhetoric by the Fed. Nevertheless, the net risks still point to a slightly more optimistic Fed tone which should help lessen any selling pressure on the dollar even if there is only limited scope for gains.

The existing home sales data was weaker than expected with a drop to an annualised rate of 5.45mn for December from 6.45mn the previous month, but prices rose and inventories declined which should provide some support early in 2010.

Overall confidence in the Euro remained fragile with a decline in German consumer confidence for the fourth consecutive month added to the sense of unease and the Euro retreated from highs around 1.4190 to consolidate near 1.4150. The Euro will tend to weaken if there is a weaker than expected German IFO report on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The trend for a slightly firmer dollar continued in Asian trading on Monday with risk appetite slightly stronger following as Asian equity markets looked to stabilise following the sharp losses seen over the second half of last week. There was also greater optimism that Bernanke would be confirmed as Fed Chairman for a second term which helped underpin demand for higher-risk assets.

Domestically, the monthly Tankan manufacturing index strengthened to -19 for the latest reading which was the highest level since September 2008 which helped improve sentiment towards risk appetite slightly. The net impact was a slightly weaker yen on improved risk conditions with the dollar edging higher to the 90.25 region.

The dollar resisted a further test of support below the 90 level in subdued trading, but was unable to make any significant headway as there was still a high degree of caution.

Sterling

Sterling held above 1.61 against the dollar in early Europe on Monday and maintained a firmer tone during the day.

There were further expectations that the GDP data due for release on Tuesday would record positive growth and this helped underpin Sterling confidence during the day. The most likely outcome is certainly that there will be positive growth for the quarter, but there is a risk that the expansion will be weaker than expected.

There would be huge selling pressure on Sterling in the event of a further decline in GDP, but this looks unlikely.

With a lack of confidence in other major currencies, Sterling was able to secure some further net relief and pushed back above 1.62 against the dollar. The Euro hit tough resistance close to 0.88 against the UK currency.

Swiss franc

The dollar was unable to gain any traction above 1.0420 against the franc on Monday, but resisted significant selling pressure. The Euro drifted back towards the 1.47 region as underlying confidence in the currency remained weak.

There were no reports of National Bank intervention during the day, but markets will inevitably remain very sensitive to the threat of central bank action to weaken the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

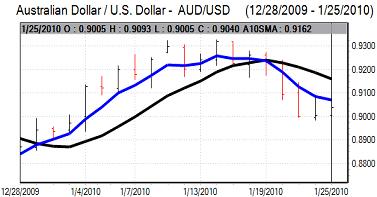

Australian dollar

The Australian dollar edged stronger to 0.9060 against the dollar on Monday as risk conditions looked to stabilise. There is still likely to be a more cautious attitude towards risk which will curb demand for the Australian currency and buying interest is liable to be measured.

The currency was unable to push above the 0.91 level and consolidated close to 0.9050 against the US dollar later in the US session as Wall Street looked to secure a partial recovery from sharp losses seen last week.