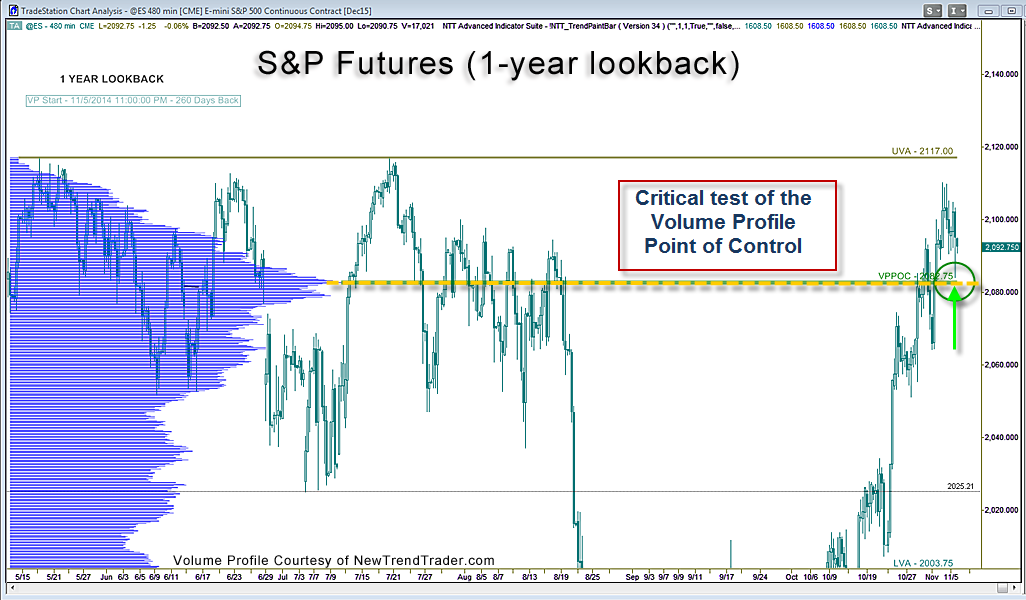

Almost four weeks ago I wrote an article for Trader Planet setting out a target for the S&P futures (2082). It was an easy call. Volume Profile had formed a very significant ledge at that level, called the Volume Profile Point of Control. Price gets drawn back to that high volume zone like iron to a magnet, since any significant trend reversal would have to begin there.

I was expecting that this zone would serve as a target for the rally, but I was also concerned that it would provide serious resistance…potentially a long kiss goodbye to the 6-year Bull.

I was half right. The target has been hit, but it has also surpassed. This is very good news for the bulls.

Yesterday we began testing the shelf from above (the low of the day was 2084). If you are familiar with the principles of technical analysis, you know that resistance can become support. The transformation from ceiling to floor requires testing, however, often more than once, and that is the process going on now in the market.

One of the nagging issues is whether the S&P can make an all-time high while the Nasdaq has to deal with a bear market in Biotech. The Nasdaq is like an army where one 4-star General has gone rogue and needs to be contained. The ideal scenario is that capital rotates in an orderly manner out of biotech and into other Nasdaq names. The earnings pop in Facebook (FB), which now has a valuation about half that of Apple, is an indication that this process may be is happening.

If you remember the bull market in the 1990s, sub-sector rotation was the engine that drove the bus: fast money flew from chips, to biotech, to software, to networking, to dot coms and back again, with cycles lasting a few weeks.

Bottom line: look for new all-time highs in the S&P and Dow shortly. Santa is coming to town.

It’s tricky to trade a rotational market because the cross-currents make it unusually choppy. If you need psychological or technical assistance:

I offer peak performance services for traders at banks and hedge funds through

www.trader-analytics.com