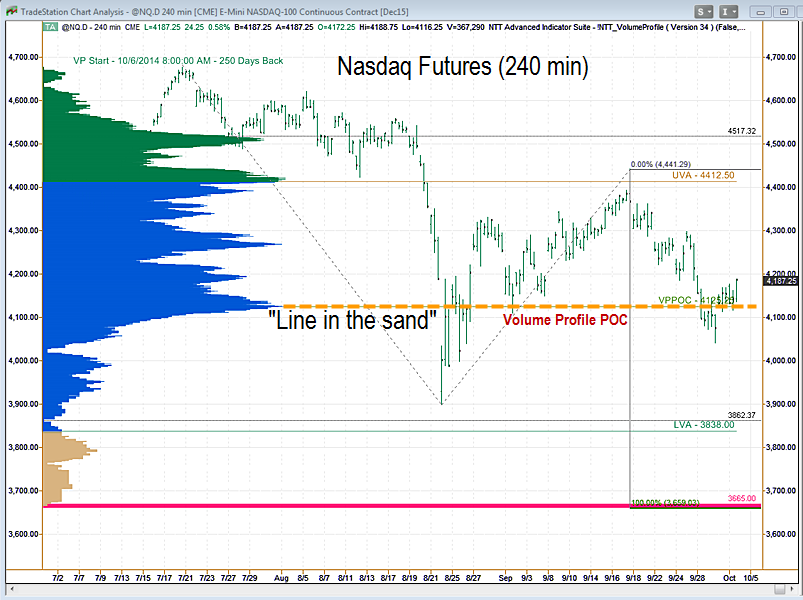

A few days ago I wrote an article for TraderPlanet with a very bearish target for the Nasdaq futures. The target, 3665, appears on the chart accompanying this article as well.

The good news for the Nasdaq bulls, which I assume is almost everyone, is that on Thursday the index stood on a “line-in-the-sand,” looked over the cliff and decided it was not yet time to jump.

That line in the sand is the Volume Profile Point of Control currently at 4125. That level was 4268 on Tuesday morning and frankly, things looked dicey at the close for the 4-letter crew.

Nonetheless, the VPPOC notched lower by about 140 points after the Tuesday sell off and the overnight bounce added some anti-gravity juice at the open on Wednesday. By the way, the VPPOC is the price at which the most volume over the look-back period occurred.

The Volume Profile principle is simple: if you are a Bull you want the VPPOC to be below you, so it functions as support. And vice versa if you are a Bear. Lowering the floor, so to speak, helped the VPPOC function as a stable platform for a breathtaking rally in the final 20 minutes of Thursday’s day session.

Fortunately, in the Nasdaq 100 futures, the bullish side of the VP coin is now facing up. Although the NQ is not out of the woods, it will enjoy some breathing room. That said, keep the 4125 level in mind and put an alert there. If we revisit it, that would be bearish.

To find out more about how to stay disciplined in this volatile market visit: http://www.daytradingpsychology.com/increasing-trader-discipline/