Do they know something we don’t know?

Gold did pretty well last week. The futures traded up $33 to close at $1137.80 an ounce, and more important, reversed the sharp decline that has seen the gold futures trade down $70 over the preceding three weeks.

The paper gold market got a boost from the real world when the Russian central bank revealed it has added 1 million ounces of gold – more than 31 metric tonnes – to its reserves in the month of August. That’s on top of increases of about 13 tonnes in July and 24 tonnes in June. Since 2007, Russia’s gold reserves have tripled.

Other nations are also stockpiling physical gold – do they know something we don’t now? – but despite the steadily increasing demand for physical metal, the futures – “paper gold” – have traded steadily lower since the beginning of 2011.

Now traders are starting to take interest in gold again, both as a “safe haven” when the world economy is teetering, and as a trading vehicle. The tine may be right to join them

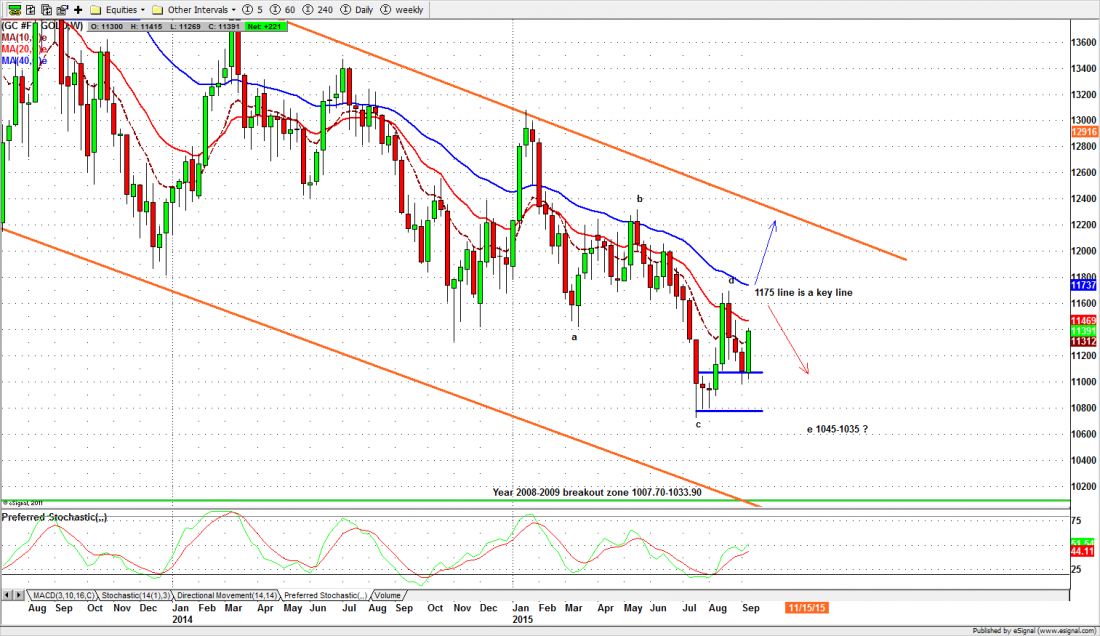

Short-term outlook

It is quite clear that the$1100 level has become a major support for this week. Now the big decision level is the $1175 line. A break above it could be followed by a move up to the next resistance level $1224.

Early in the week we want to see gold holding above $1124-18, to ensure that the tentative uptrend doesn’t change direction. There are also a number of longer-term support levels that must hold to forestall any further declines:

- Long-term support: $1007-$1034, the yearly breakout level

- Long-term trendline: $1009.50 this week.

- Intermediate term support: $1045-$1035

- Short-term support: $1072-$1095

But as long as the price stays above those support levels – and right now it looks like it will — the steady accumulation in gold will continue. And any weakness in the US dollar will accelerate the process.

It is time to watch gold closely. This is starting to smell like the beginning of a pretty good bounce. Our traders are looking for a retracement to get in.

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: Gold futures, weekly chart, Sept. 18, 2015