One would have thought the market makers read my last post on August 18th for Trader planet “using price and time to predict market reversals” There was an open gap at 2102 that I said would most likely get filled before the meaningful “mini crash” started. Which I have warning about throughout August.

After a big that day, the SPX made a massive reversal-started a short squeeze and closed that 2102 gap. That was the “price piece” of using time and price to predict market reversals. Once the gap was filled, the SPX started the “mini crash” (Kill Zone) Woody Dorsey was predicting to hit between August 14th-21st (that was the time piece of using “time and price to predict market reversals”)

The SPX lost 240 points from the day that article was published on Trader Planet and be warned, the worst has not even hit yet. Woody Dorsey is predicting there are (2) Black Holes scheduled to hit in September. The last Black Hole Woody predicted 3 weeks before it hit-was September 19th 2014 and the SPX dropped 200 points.

The recent drop the SPX just had was part of the “Kill Zone” and it is just the start of a huge jump in volatility and the black holes set to hit in September, could be much worse than what we just saw-and that shaved 240 points off the SPX. There are many ways you can buy protection-and any bounces or rallies, should be used to do just that. Use it as an insurance policy in case these black holes do as much damage to the SPX than the kill zone just did.

Time and Price

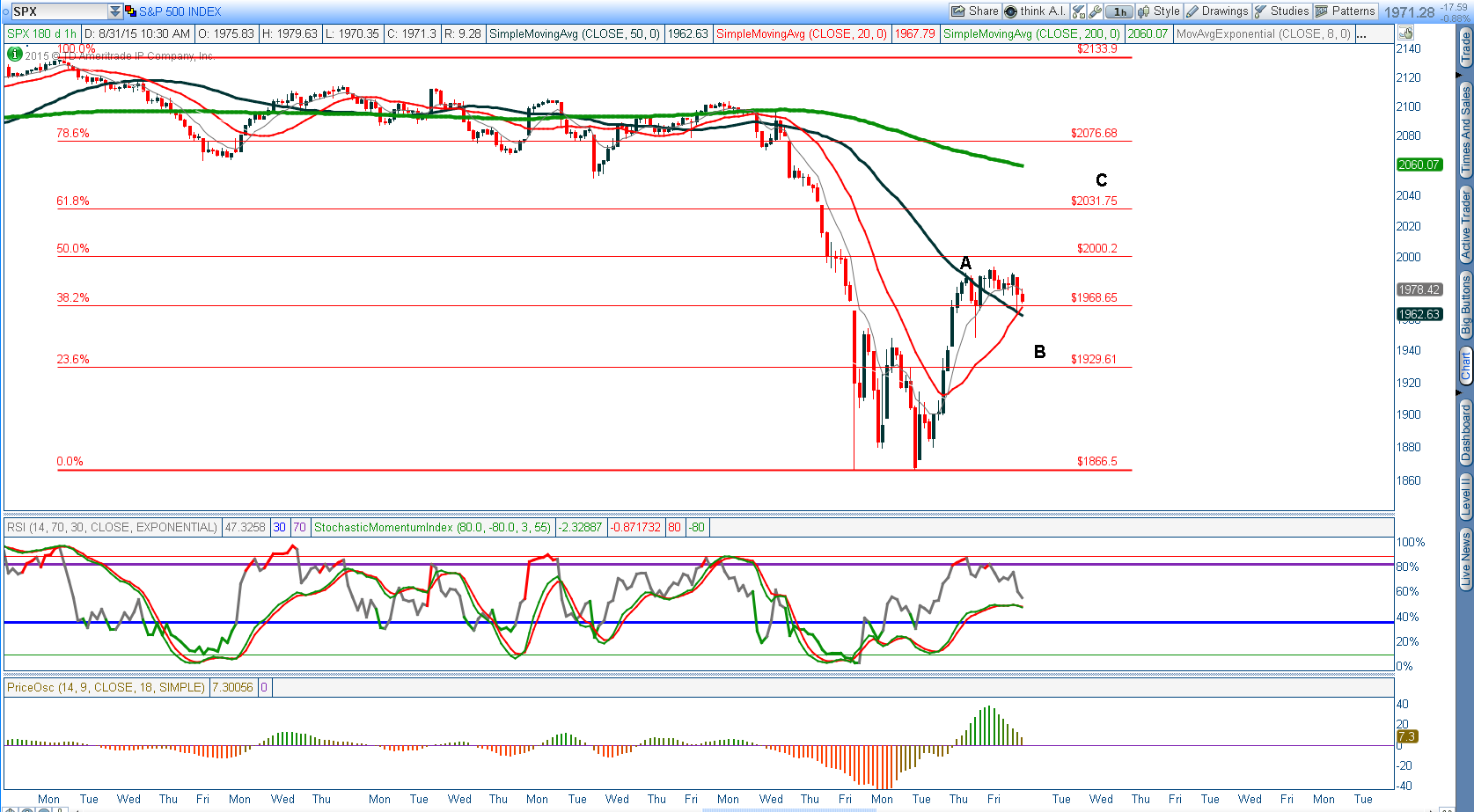

The best chart pattern I see right now-is the recent 2 day rally is a wave (A) up-and the current weakness is part of a wave (B) down. There SHOULD be a wave (C) up next and that could take the SPX between the 2031-2076 target zone and it should complete right when the 1st black hole is scheduled to hit. The 1966 lows just made should be taken out fairly quickly if all goes as planned.

Tap here to get the next turn date free