A week ago shares of Tesla (TSLA) were being rather aggressively sold after the company failed to impress with Q2 results. Some analysts lowered price targets and technically the stock looked ‘toppy.’

Despite the lackluster news, however, the selling quickly dried up, shares found support around $231 and began to bounce with the rest of the market on 8/12. That was the first sign that investors were not abandoning ship.

Fast forward to Monday when die-hard Tesla fans were treated to an uber-bullish note by analyst Adam Jonas at Morgan Stanley. Jonas raised his price target to $465 after noting that Tesla Motors is uniquely positioned to exploit the Uber shared mobility model, which is a viral phenomenon in metropolitan areas around the globe. And when one includes the autonomous driving element in the calculations, the eminently rational Jonas became, well, exuberant.

Jonas believes Tesla management will roll out a shared mobility program within 18 months in order to keep up with competitors such as Apple. And when Jonas looks about 14 years down the road, he sees very rosy top line growth for Tesla.

While pricing in the uber-potential may be a bit premature, Jonas believes a transportation revolution is already underway and changes will happen at an accelerated pace. I test drove a dual motor Model S this weekend, which has a total of around 650 hp at zero rpm. It is nothing short of an uber-experience.

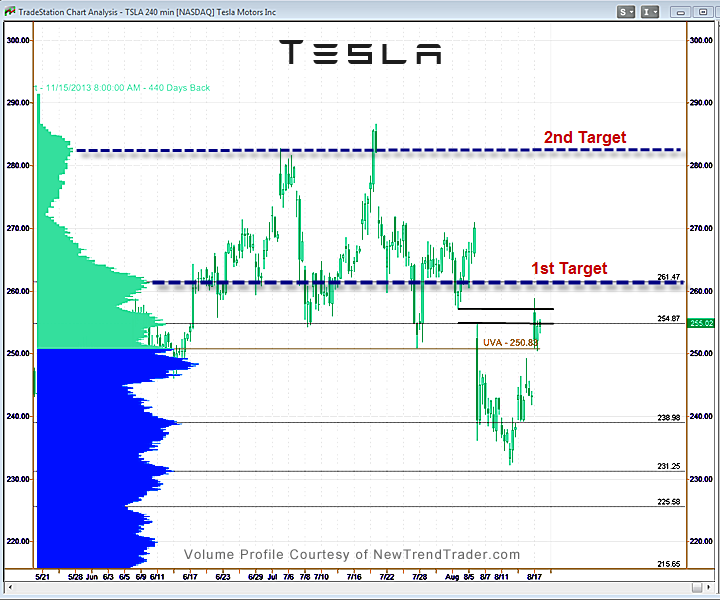

If the market remains positive, shares of Tesla are probably headed higher in the short term and the chart shows two upside targets.

If you would like to receive a free primer on using Volume Profile, please click here