Unusual Options Activity

On August 12th, someone closed 17,500 WBA Jan 2016 $75 calls ($17.93 credit) and rolled out to 17,500 Jan 2016 $95 calls ($4.85 debit). He/she also bought back 16,000 Jan 2016 $65 puts for $0.20. Call activity was 6 times the average daily volume. The hedge fund or institutional trade took profits, but still sees upside above $100 over the next five months (breakeven is at $99.85).

Fundamentals

In mid-2012, Walgreens acquired a 45% stake in Alliance Boots, a Switzerland-based health and beauty company, for $6.7B in cash and stock. This expanded their exposure into Europe, making them the largest prescription drug buyer at the time. Just late last year they acquired the remaining 55% in a deal valued at $15.3B. WBA trades at a P/E ratio of 20.61x (2016 estimates) with mid to high teen’s annual earnings growth. Sales are projected to top $100B this year and then jump an additional 17%+ in 2016.

On July 16th, Credit Suisse upgraded the stock to outperform from neutral and upped their price target to $110 from $90. Analysts cited cost savings of the Alliance Boots merger could be more than the $1.5B per year management forecasted and a potential deal with AmerisourceBergen or others.

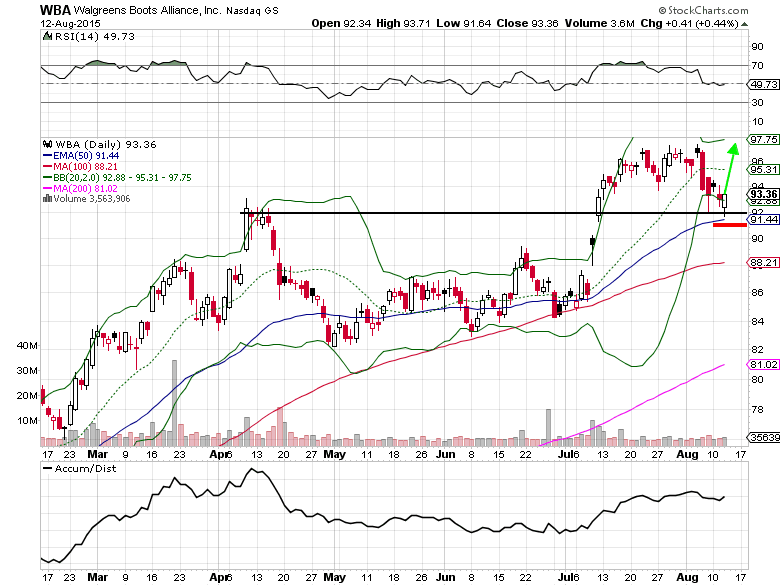

Shares of WBA broke out above the $92 resistance level in July and went off to rally above $97 before pulling back. The stock is finding support at prior resistance ($92), which is also near the 50-day exponential moving average. Now is the time to consider buying shares, using a stop loss under $91.40. Look for a move to $100+ in the coming months (reward/risk ratio of 3:1).

Walgreens Boots Alliance Options Trade Idea

Buy the Jan 2016 $95/$105 bull call spread for a $3.15 debit or better

(Buy the Jan 2016 $95 call and sell the Jan 2016 $105 call, all in one trade)

Stop loss- None

1st upside target- $6.00

2nd upside target- $9.50