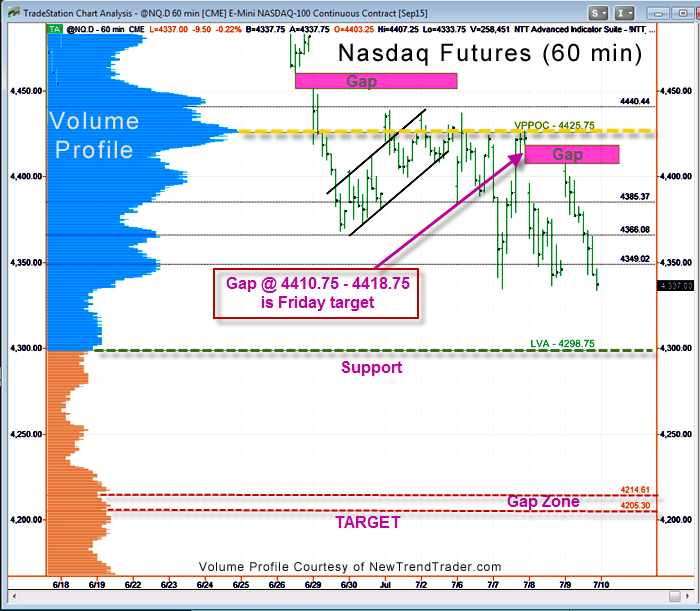

As the week progressed, the Nasdaq became weaker, not stronger, and left a number of unfilled gaps in its wake. This is what happens when the European tail wags the US dog overnight. Additionally, concerns about the new bear market in China, which is likely to take the Shanghai index down more than 80% from its high, are likewise distorting the US open.

The closest gap is between 4410 and 4418, so look for that to get filled on Friday morning. I’m expecting that because during corrections, markets tend to rally in the morning and sell off in the afternoon.

With a rather robust-looking Volume Profile Point of Control (VPPOC) at 4425, however, the Nasdaq is likely to have a difficult time surpassing that level. On the flip side, as I pointed out earlier in the week, the gap way down at 4206 is beckoning. The S&P futures have a similar gap at 2003. Uh oh.

That said, so far the US market is the global safe haven for capital, so we are not feeling the dual drama in our indices. Small caps, generally a good bellwether, are holding steady and if the heady Biotech index (IBB) hangs tough, then a deeper correction will be postponed.

If not, then look for 4206 sooner than later.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here