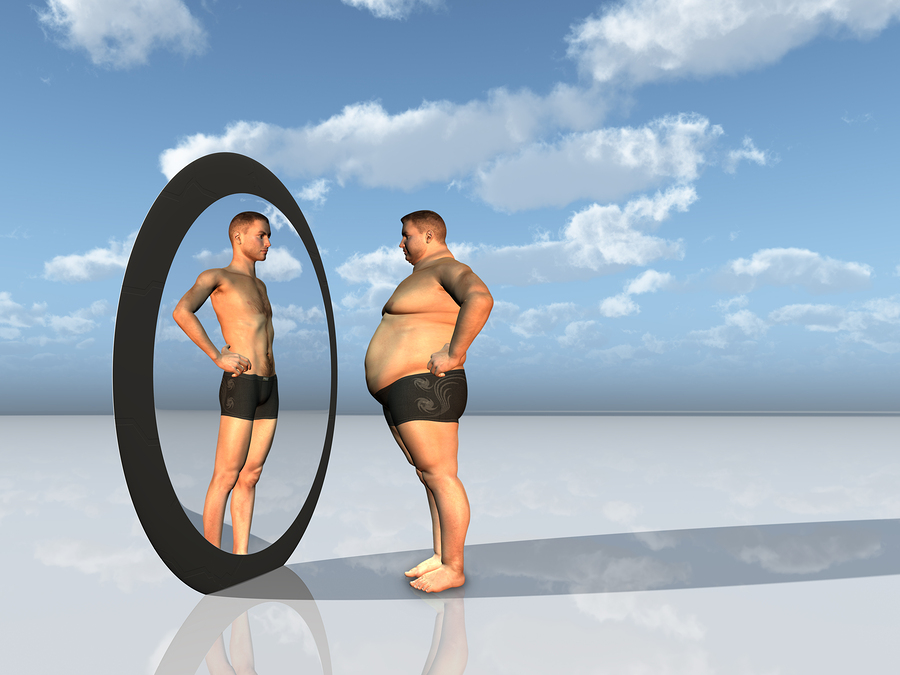

I get a chuckle out of this picture because it clearly depicts one of the more slippery psychological factors that affect our bottom line results as traders: our inability to see ourselves as we really are.

I have a Peanuts cartoon framed on the wall behind my trading desk that depicts Lucy giving psychiatric advice to Charlie Brown for 7 cents at an outdoor stand. She explains to Charlie that the brain works hard at night in dreams “to help you see yourself as you really are.” In the final frame Charlie concludes “Even my brain is against me!”

When it comes to trading, I believe Charlie Brown is right. There are three ways that your brain is likely to object to your trading project.

First, a part of your brain called the amygdala is going to think you have lost your mind when you put on a trade. This tiny organ, the size of an almond, is your survival monitor and it goes on alert every time you click to open a trade, whether you can afford the potential loss or not.

To counteract that fear circuit, your reward circuit kicks in at the same time and makes you excited about the possibility of the win. In other words, you are caught in the middle of a neurological approach-avoidance argument inside your head.

In addition, your brain is pre-programmed to take small wins and avoid even modest losses, so when your stop is about to be hit, you will probably feel an urge to move it. This is how small losses become large losses.

If your brain is working against you, you are fighting a war on two fronts: an outer battle with the market and an inner battle with yourself. This is why you become vulnerable to making what we call in tennis lingo “unforced errors.” You might be a genius in SIM, but live trading can make fools of us all.

The more you know about yourself, however, the better prepared you will be to counteract some of these automatic self-limiting tendencies. To learn more about your own trader personality visit the link below where you can take a free profile and get instant results.