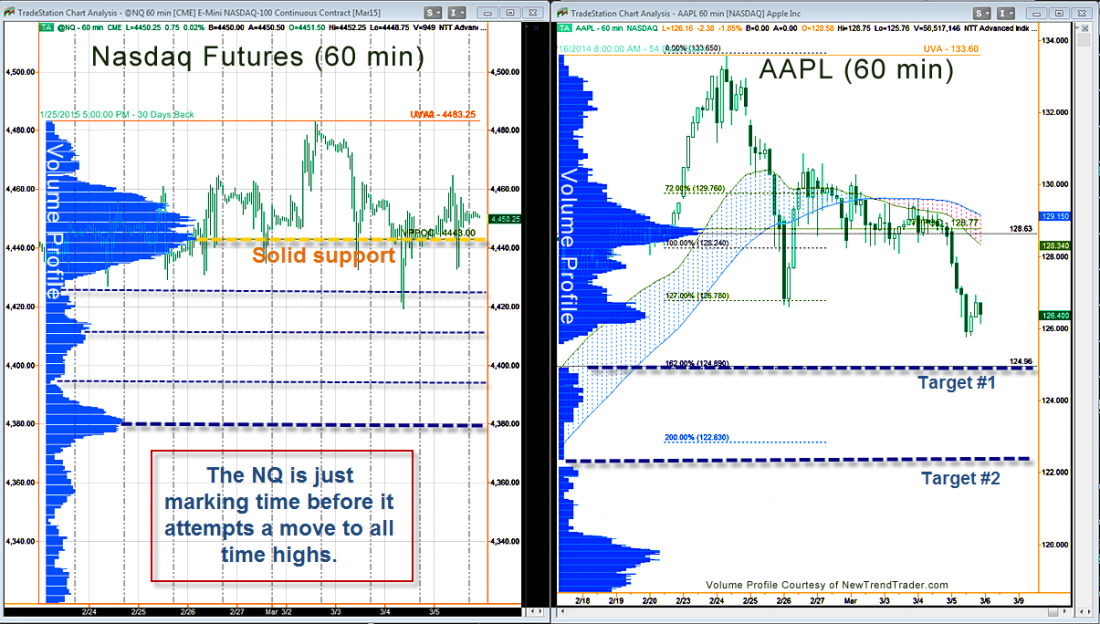

The tale of the Nasdaq 100 is a story of an index that just won’t die or even stumble. Its #1 player, Apple (AAPL), fell almost 2% on Thursday and the NQ closed up on the day. To me, this suggests rather strongly that the Nasdaq 100 is not done going up.

The futures once again closed the day session very near to the Volume Point of Control (VPOC), which is now 4443. The size of the volume histogram peak at that level means this zone is in a rotational equilibrium. In other words, just as many folks are getting on the train as are getting off.

AAPL will most likely test its $125 gap on Friday. The NQ is likely to shrug this off.

My upside target zone for the NQ futures is 4525-4530, but much higher targets follow thereafter. The downside targets are indicated by blue dotted lines, just in case.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the S&P futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.