In the beginning of December, after the SPX had rallied some 250 points, the “herd” conceded that the Santa Rally was in full swing and everyone must just jump in and forget about waiting for a pullback; it wasn’t coming.

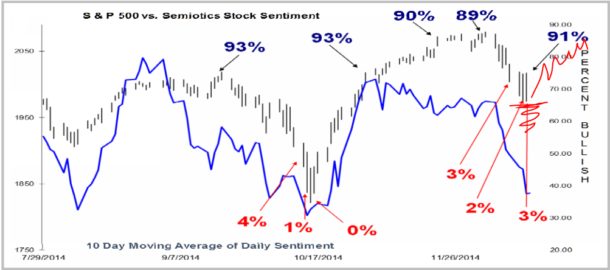

There was a turn date identified for December 8th and it was warning of a drop. Short- and intermediate-term sentiment was at extreme bullish levels, which supported the December 8th expected drop.

December 8th ended up being the exact top, and when we witnessed the SPX take its first real drop since the October lows, everyone who missed the rally was quick to buy the first dip. But once the SPX broke support, everyone started saying the Santa Rally had already come and gone and we saw some panic hit as the SPX dropped 100 points.

Unfortunately, everyone who panicked and believed the Santa Rally had come and gone watched the SPX make back all of the losses in just three days. Now, nobody believes the rally can continue higher –“Tis The Season Of Denial”.

The expected drop on December 8th was a trade that worked. We had a series of very bearish sentiment readings suggesting that the trade was nearing an end. Our expected turn-date low wasn’t until December 22nd, but, obviously, it came early. If it weren’t just a trade, we probably would have seen more weakness into the 22nd turn date, but the bearish sentiment levels were a warning to get conservative on the short side.

#####

There are some very important turn dates approaching, which may take many by surprise, so please stay current with trading sentiment. Click here.