OPTION TRADE OF THE DAY!

June 24, 2009

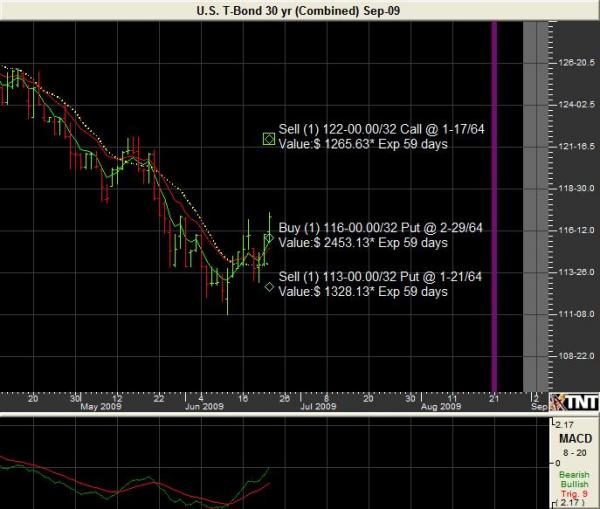

T-Bonds are showing signs of what could be a key reversal of its latest digestive move. We are buying the August 116 puts; selling the August 113 puts and selling a naked 121 call. The trade is a debit of under $200 before factoring in transaction costs, the risk above 121 is unlimited while the profit potential is $3,000 before factoring in costs ($200 plus 3 commissions) with the market trading under 113 before expiration in July.

* There is a substantial risk of loss in trading futures and options.

PLACING CONTINGENT ORDERS SUCH AS “STOP LOSS” OR “STOP LIMIT” ORDERS WILL NOT NECESSARILY LIMIT YOUR LOSSES TO THE INTENDED AMOUNTS. SINCE MARKET CONDITIONS MAY MAKE IT IMPOSSIBLE TO EXECUTE SUCH ORDERS.

Past performance is not indicative of future results.

The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Alaron Trading Corp. its officers and directors may in the normal course of business have positions, which may or may not agree with the opinions expressed in this report. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

Paul Brittain

Commodity Trading School

877-270-8403