Since December 2008, Treasury bond futures prices have seen a substantial downturn. The flight-to-quality bid has eased as the economy has improved, and we’ve seen an increase in supply as the government has been selling Treasury instruments to fund economic stimulus measures. As supply goes up, people will demand a higher return (interest rate) on their bonds as a result, and yields have moved up accordingly. I think some of the rise in yields we’ve seen recently may be a bit premature, and we may see Treasuries bounce a bit as a result. However, the longer-term trend in yields looks up, as inflation becomes more of a problem down the road. If you are a longer-term trader, I’d recommend using a potential short-term bounce to set up for another wave lower in Treasury futures.

If you’ve never traded Treasuries before, the concept of price versus yield is important. When you hear the term “yield curve,” it refers to the relationship between various interest rate products. Yields moving from the shortest-dated Treasury instruments, such as Federal funds or Treasury bills, are typically much lower than longer-dated instruments, such as Treasury 10-year notes or 30-year bonds. Investors want to be compensated for tying up their money for a longer-period of time, so the yield curve tends to slope upward as we move out in time.

The price of Treasury bond and note futures moves conversely to the yield. Longer-dated instruments (i.e., 30-year Treasury bond) are more sensitive to changes in interest rates. That means a change in interest rates will typically result in a larger corresponding price move in the price of the 30-year bond, than say, a two-year note.

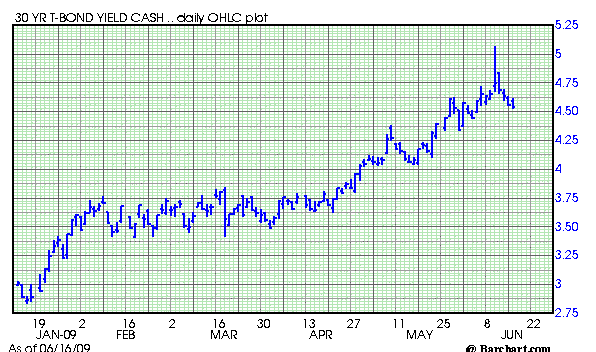

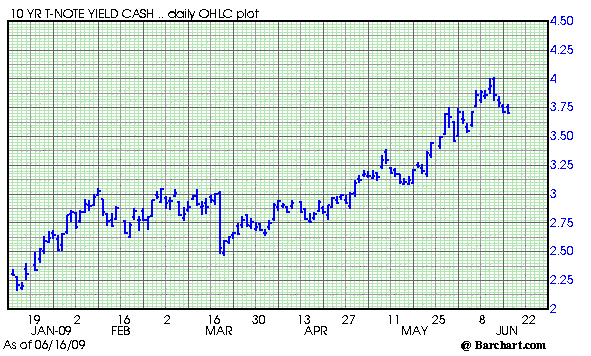

We can see that in December 2008, Treasury bond futures were trading above 141-00, while the corresponding cash yield was slightly above 3 percent. The 10-year note was trading at 128-00 in December 2008, and was yielding about 2.87 percent. In June 2009, as futures prices bottomed, the 30-year bond yield ticked up to about 5 percent, and the 10-year note yield climbed to about 4.25 percent.

30-Year Treasury Bond Futures (Price)

30-Year Treasury (Cash Yield)

10-Year Treasury Note (Price)

10-Year Treasury Note (Cash Yield)

Higher Yields May be Premature

We can see the trend in Treasury futures has been down in the past few months, but I think yields probably got a little ahead of themselves. The economy isn’t quite healthy enough yet to sustain a further increase. I think we might see Treasury bond prices correct a bit higher as yields back off a bit in coming days or weeks. Part of the reason interest rates have come up is because of the potential for inflation, which the Federal Reserve will likely have to deal with—but not for a while.

What we heard at the recent Group of Seven meeting, and from Fed presidents speaking recently, the view that inflation speculation is premature. We’ve had few signs of it. The May Producer Producer Price Index (PPI), which reports inflation at the wholesale level, showed a smaller increase than expected, at 0.2 percent, and fell 0.1 percent excluding food and fuel, the first drop since October 2006. We’ll see how that transfers to prices at the consumer level next, in the upcoming Consumer Price Index (CPI) report. Inflationary numbers in these reports would cause Treasury yields to rise and futures prices to drop. But so far, they aren’t showing a whiff of inflation.

I think the market got oversold and don’t see things terribly inflationary right now, so I would use a bounce as an opportunity to get back in on the short side of the market. As soon as the economy improves, the potential for inflation is high. There will be a problem if the Fed doesn’t try to rein in interest rates.

There is a fear that foreign investors are losing confidence in the dollar, and may turn to alternatives to holding Treasuries. Brazil, Russia, India and China (the so-called “BRIC” countries) have combined reserves of $2.8 trillion and are among the largest holders of U.S. Treasuries, according to a Bloomberg article. They have said they are considering buying each other’s bonds and swapping currencies to lessen dependence on the U.S. dollar. If we see a loss of foreign appetite for Treasuries, that certainly will impact prices.

However, I don’t expect international demand to weaken any time soon. Once the world’s economies are back on track, I think some of these foreign interests will start to look at what debt they are holding and how much, but for now, there really is no alternative. There is nothing else that’s liquid enough to take the place of the dollar and U.S. Treasury instruments.

From a technical point of view, support has been holding in the 30-year bond futures near 112-00. The 25 percent Fibonacci retracement level from the December highs to recent lows comes in at 119-12, which I see as a good area to establish a potential short position. The 38 percent retracement comes in at 123. However, if a rally starts stalling near 117, you might want to consider getting short there if you are more aggressive.

In the September 10-year note futures, I see resistance at 119, the 50-day moving average. If the market starts to stall and makes new lows, you might just want to do with the momentum of the trend.

Fed Funds Futures Anticipate Rate Changes

The Fed doesn’t actually control interest rates. What they do is set a target for the Federal Funds rate, a rate at the very short-end of the yield curve that represents the overnight lending rate between banks. The Fed buys and sells Treasuries in the open market to try to achieve their rate target.

You can see how market participants are pricing in possible rate changes from the Federal Reserve in the months and years ahead through Federal Funds futures contracts. Fed Funds futures are a 30-day contract, traded at CME Group. In simple terms, all you do is subtract 100 from the market’s price to get an implied interest rate. So for example, the December Fed Funds futures contract is trading near 99.635, so you get 0.42 percent. That implies by the end of the year, we’ll see only a very small rate increase from the rate we are at today (near zero). The March 2010 contract is trading at 99.235, implying by that time, the Fed funds rate will be at 0.765 percent. So the market is pricing in expectations that the Fed will have to start increasing rates to fight potential inflation as the economy improves.

Eurodollar futures also offer a similar view of short-term interest rate expectations, in a more liquid contract. In fact, it’s one of the most heavily traded interest rate products in the world. Remember that we aren’t talking about currencies; the Eurodollar is, in a nutshell, the rate you’d get if you deposited $1 million in banks outside the U.S. (overseas) for three months’ time. This product tends to see some nice moves farther out in time, because the chance of rates changing are higher.

You can see the move in the 2010 contract below, when expectations about the economy began to change. Similar to the Fed Funds examples, subtracting the price of the December 2010 contract (97.53) from 100 implies a rate of just under 2.5 percent on your foreign deposit.

Eurodollar Futures, September 2010

Deciding which of these various interest rate contracts to trade and how depends on your interest, your account size, and your risk-tolerance. You can also trade options on these contracts, which can offer you defined risk.

Feel free to contact me with any questions you might have about options or futures trading, and how to incorporate some of these concepts into specific trading strategies in the markets today.

Matt Krupski is a Senior Market Strategist with Lind Plus. He can be reached at 877-847-3034 or via email at mkrupski@lind-waldock.com.

You can hear market commentary from Lind-Waldock market strategists through our weekly Lind Plus Markets on the Move webinars . These interactive, live webinars are free to attend. To sign up, visit https://www.lind-waldock.com/events/calendar.shtml . Lind-Waldock also offers other educational resources to help your learn more about futures trading, including free simulated trading. Visit www.lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and is not suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading . 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.