October hogs closed down $1.85 at $52.05. October hogs closed sharply lower on Monday due to sharply higher gain prices ending a one-day short covering rally off last week’s low. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If October extends this summer’s decline, weekly support crossing at 50.65 is the next downside target. Closes above the 20-day moving average crossing at 56.82 are needed to confirm that a short-term low has been posted. First resistance is the 10-day moving average crossing at 54.55. Second resistance is the 20-day

moving average crossing at 56.82. First support is last Wednesday’s low crossing at 51.70. Second support is weekly support crossing at 50.65.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

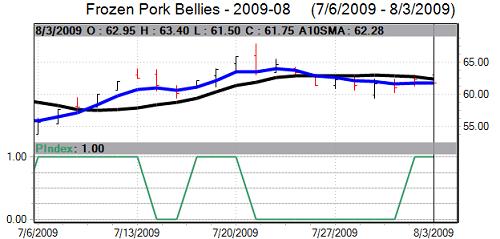

August bellies closed down $0.50 at $61.75. August bellies closed lower on Monday due to profit taking while extending last week’s trading range. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. Multiple closes below last Wednesday’s low crossing at 59.50 would confirm that a short-term top has been posted. If August renews the rally off July’s low, the June 2nd gap crossing at 68.90 is the next upside target. First resistance is today’s high crossing at 63.40. Second resistance is the reaction high crossing at 67.75. First support is last Wednesday’s low crossing at 59.50. Second support is the reaction low crossing at 59.35.

October cattle closed up $0.12 at 90.32. August cattle closed higher due to short covering on Monday. Profit taking tempered early session gains and the low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are neutral tobearish signaling that sideways to lower prices are possible near-term. If October extends the decline, the reaction low crossing at 88.00 is the next downside target. Closes above the reaction high crossing at 91.10 would temper the near-term bearish outlook. First resistance is the reaction high crossing at 91.10. Second resistance is July’s high crossing at 92.05. First support is last Wednesday’s low crossing at 88.85. Second support is the reaction low crossing at 88.00.

October feeder cattle closed down $0.52 at $102.00. October Feeder cattle closed lower on Monday as it extends last week’s trading range. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If October extends the decline off July’s high, the reaction low crossing at 101.40 is the next downside target. Closes above the 20-day moving average crossing at 103.03 are needed to confirm that a short-term low has been posted.