October sugar closed down 40 points at 16.92 cents yesterday. Prices closed near the session low and scored a bearish “outside day” down on the daily bar chart. More profit-taking pressure was featured yesterday and no serious chart damage occurred. The key “outside markets” were bearish for sugar futures again yesterday. Crude oil prices were lower, stock indexes were lower and the U.S. dollar was firmer. World supply and demand fundamentals are still bullish for the sugar market. The sugar bulls still have the near-term technical advantage. Bulls’ next upside price objective is to push and close prices above technical resistance at last week’s contract high of 18.09 cents. Bears’ next downside price objective is to push and close prices below solid technical support at 16.50 cents. First resistance is seen at 17.25 cents and then at 17.50 cents. First support is seen at yesterday’s low of 16.90 cents and then at 16.75 cents.

Wyckoff’s Market Rating: 6.5

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

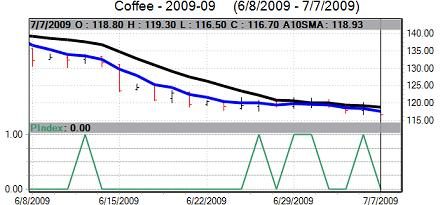

September coffee closed down 80 points at 117.30 cents yesterday. Prices closed nearer the session low and hit another fresh nine-week low yesterday. The key “outside markets” were bearish for coffee futures again yesterday. Crude oil prices were lower, stock indexes were lower and the U.S. dollar was firmer. Prices are in a five-week-old downtrend on the daily bar chart. Coffee bulls’ next upside price objective is pushing and closing prices above solid technical resistance at 125.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 115.00 cents a pound. First support is seen at yesterday’s low of 116.50 cents and then at 115.00 cents. First resistance is seen at yesterday’s high of 119.30 cents and then at this week’s high of 120.20 cents.

Wyckoff’s Market Rating: 2.5

September cocoa closed down $21 at $2,453 yesterday. Prices closed near the session low. The key “outside markets” were bearish for cocoa futures again yesterday. Crude oil prices were lower, stock indexes were lower and the U.S. dollar was firmer. Also, there is now talk of a big cocoa crop being harvested in West Africa, the world’s largest producing region. Prices yesterday closed at a fresh six-week low close. Bears have the near-term technical advantage. The next upside price objective for the cocoa bulls is to push and close prices above solid technical resistance at $2,600. The next downside price objective for the bears is pushing and closing prices below solid technical support at $2,400. First resistance is seen at $2,500 and then at yesterday’s high of $2,537. First support is seen at this week’s low of $2,444 and then at last week’s low of $2,426.

Wyckoff’s Market Rating: 4.0.

December cotton closed down 53 points at 59.71 cents yesterday. Prices closed near mid-range yesterday. The key “outside markets” were bearish for cotton futures again yesterday. Crude oil prices were lower, stock indexes were lower and the U.S. dollar was firmer. The next downside price objective for the bears is to produce a close solid technical support at 58.00 cents. The next upside price objective for the bulls is to produce a close above solid technical resistance at the June high of 62.63 cents. First resistance is seen at 60.00 cents and then at this week’s high of 60.65 cents and then at last week’s high of 61.29 cents. First support is seen at 59.00 cents and then at yesterday’s low of 58.51 cents.

Wyckoff’s Market Rating: 6.0.

September orange juice closed up 125 points at $.8750 yesterday. Prices closed near mid-range and did close at a fresh three-week high close yesterday. Importantly, the bulls were able to show follow-through buying strength from big gains on Monday. Bulls have gained

fresh upside near-term technical momentum. The next downside technical objective for the FCOJ bears is to produce a close below solid technical support at $.8000. The next upside price objective for the OJ bulls is pushing prices above solid technical resistance at $.9000. First resistance is seen at $.8800 and then at $.8900. First support is seen at $.8700 and then at $.8600.

Wyckoff’s Market Rating: 4.5.

September lumber futures closed up $1.00 at $207.50 yesterday. Prices closed near mid-range and did hit a fresh six-week low early on yesterday. Bears have the near-term technical advantage. The next upside technical objective for the lumber bulls is pushing and closing prices above solid technical resistance at $217.70, which would fill on the upside a downside price gap on the daily chart. The next downside price objective for the bears is pushing and closing prices below solid support at $200.00. First resistance is seen at yesterday’s high of $209.50 and then at $212.00. First support is seen at yesterday’s low of $205.10 and then at $202.50.

Wyckoff’s Market Rating: 3.5.