August gold futures closed up $6.50 at $930.80 yesterday. Prices closed nearer the session low after scoring solid gains early on. The late rebound in the value of the U.S. dollar yesterday pushed gold down from its earlier highs. Short covering and perceived bargain hunting were featured again yesterday. Gold prices are still in a three-week-old downtrend on the daily bar chart. Bears’ next downside price objective is closing prices below solid technical support at $900.00. Gold bulls’ next upside price objective is to push and close prices above solid technical resistance at yesterday’s high of $944.40. First resistance is seen at $935.60 and then at yesterday’s high of $944.40. Support is seen at yesterday’s low of $922.80 and then at $918.00.

Wyckoff‘s Market Rating: 6.0.

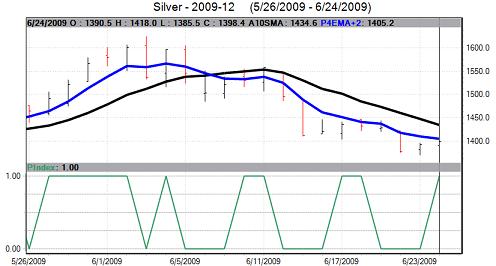

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

December silver futures closed down 6.2 cents at $13.855 an ounce yesterday. Prices closed near the session low yesterday. The key “outside markets” were mostly bearish for silver futures yesterday, as the U.S. stock indexes were mixed, and crude oil was weaker, while the U.S. dollar was firmer. Prices are still in a three-week-old downtrend on the daily bar chart. Bulls’ next upside price objective is closing prices above solid technical resistance at $14.50 an ounce. The next downside price objective for the bears is closing prices below solid technical support at $13.00. First resistance is seen at $14.00 and then at this week’s high of $14.21. Next support is seen at this week’s low of $13.695 and then at $13.50.

Wyckoff‘s Market Rating: 5.0.

December N.Y. copper closed up 580 points at 228.00 cents yesterday. Prices closed nearer the session high yesterday. The key “outside markets” were mostly bearish for copper futures yesterday, as the U.S. stock indexes were mixed, and crude oil was weaker, while the U.S. dollar was firmer. Yet, the copper market rallied anyway, which is a bullish clue. The bulls have regained upside technical momentum this week. The next downside price objective for the bears is closing prices below solid technical support at this week’s low of 214.95 cents. Bulls’ next upside objective is pushing and closing prices above solid technical resistance at 237.70 cents, which is the top of a downside price gap on the daily bar chart. First support is seen at 225.00 cents and then at yesterday’s low of 219.15 cents. First resistance is seen at yesterday’s high of 230.60 cents and then at 235.00 cents.

Wyckoff‘s Market Rating: 7.0.