Bad news kids!

Bad news kids!

I just did a huge, long-promised write-up of the 5% rule for Members and we cast our bones over the indexes and the signs do not look that good. I do not want to be bearish, I want to turn off my brain and celebrate this amazing economic recovery – maybe we can rent out one of those empty shopping malls for a party and hire a lot of former manufacturing employees for minimum wage to serve drinks (if WMT doesn’t get them first!). Oh yes, we love a good party but you know what can happenwhen you rent a mall at an inopportune time… That’s right – ZOMBIES!

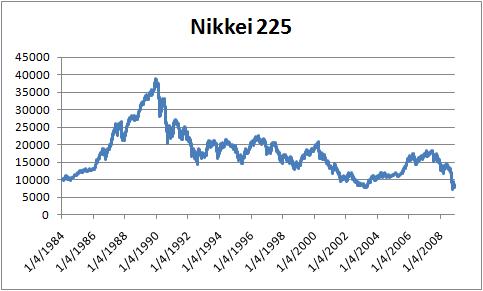

“Zombie” banks and other corporations that were propped up by the government were blamed for Japan’s “lost decade” (now in year 18), in which, according to Wikipedia, there was:”A massive wave of speculation by Japanese companies, banks and securities companies. A combination of exceptionally high land values and exceptionally low interest rates briefly led to a position in which credit was both easily available and extremely cheap. This led to massive borrowing, the proceeds of which were invested mostly in domestic and foreign stocks and securities. Recognizing that this bubble was unsustainable, the Finance Ministry sharply raised interest rates in late 1989. This abruptly terminated the bubble, leading to a massive crash in the stock market. It also led to a debt crisis; a large proportion of the debts that had been run up turned bad, which in turn led to a crisis in the banking sector, with many banks having to be bailed out by the government.”

Gosh that sounds familiar! Well thank goodness we have wise leaders whostudy globalhistory and learn the lessons of the past so that wedonot make the same mistakes that other countries have (end sarcasm font). Michael Schuman of Time Magazine noted that banks kept injecting new funds into unprofitable “zombie firms” to keep them afloat, arguing that they were too big to fail. However, most of these companies were too debt-ridden to do much more than survive on further bailouts, which led to an economist describing Japan as a “loser’s paradise.” This led to the phenomenon known as the “lost decade“, when economic expansion came to a total halt in Japan during the 1990s. The impact on everyday life was muted, however, as theJapanese people tended to be savers, not borrowers. Unemployment ran reasonably high, but not at…

Gosh that sounds familiar! Well thank goodness we have wise leaders whostudy globalhistory and learn the lessons of the past so that wedonot make the same mistakes that other countries have (end sarcasm font). Michael Schuman of Time Magazine noted that banks kept injecting new funds into unprofitable “zombie firms” to keep them afloat, arguing that they were too big to fail. However, most of these companies were too debt-ridden to do much more than survive on further bailouts, which led to an economist describing Japan as a “loser’s paradise.” This led to the phenomenon known as the “lost decade“, when economic expansion came to a total halt in Japan during the 1990s. The impact on everyday life was muted, however, as theJapanese people tended to be savers, not borrowers. Unemployment ran reasonably high, but not at…