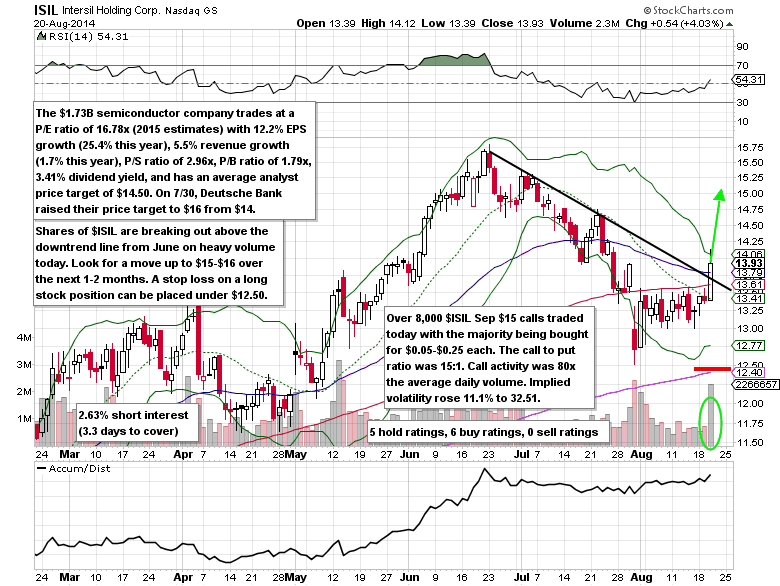

Shares of Intersil (ISIL), a $1.73B power management integrated circuits maker, are up 25% year to date this year, but only trade at a P/E ratio of 16.78x (2015 estimate) with 12.2% EPS growth (25.4% this year). Revenue growth is expected to accelerate from 1.7% this year to 5.5% in 2015. The current dividend yield of 3.41% is better than the SPDR S&P 500 ETF Trust’s (SPY) 1.80% yield and the Market Vectors Semiconductor ETF’s (SMH) 1.29% yield.

On July 30, Intersil reported Q2 EPS of $0.19 vs. the $0.18 estimate and revenue of $147.76M vs. the $147.2M estimate (2% year over year growth). They issued Q3 EPS guidance of $0.19-$0.20 vs. the $0.19 estimate and revenue of $147.8M-$152.2M vs. the $152.87M estimate. Recently, Intersil developed a power management chip that integrates the display power and LED driver in a single chip for smart phones.

Unusual Options Activity

Over 8,000 Sep $15 calls traded on August 20th (12,407 calls traded total) with the majority being bought for $0.05-$0.25 each. The call to put ratio was 15:1. Call activity was 80x the average daily volume. Implied volatility rose 11.1% to 32.51. Total call open interest was only 5,474 contracts prior to this activity.

Intersil Options Trade Idea

Buy the Sep $14/$15 call spread for a $0.35 debit or better

(Buy the Sep $14 call and sell the Sep $15 call, all in one trade)

Stop loss- None

First upside target- $0.65

Second upside target- $0.95

Disclosure: I’m long the Sep $14/$15 call spreads for a $0.33 debit.

= = =

Mitchell’s Free Trade of the Day: Call Buyers Look For 10%+ Upside In KB Home (KBH)