The lithium industry related Exchange traded fund has got energized as Tesla Motors (TSLA) plans the world’s largest battery factory, now known as the Gigafactory.

The investment will be of almost $5 billion and will create approximately 6.000 new jobs. The idea behind this plant is to help Tesla Motors mass produce half a million electric vehicles (or more) per year compared to the last figure of 35.000 units.

ETF RELATED

This news has not only had a good impact on TSLA price but also on the Global X Lithium ETF (LIT), which provides exposure to the largest and most liquid companies that are active in exploration and/or mining of lithium or the production of lithium batteries.

Although LIT does not feature Tesla among its holdings, the ETF has seen some correlation to Elon Musk company’s news.

TECHNICAL ANALYSIS

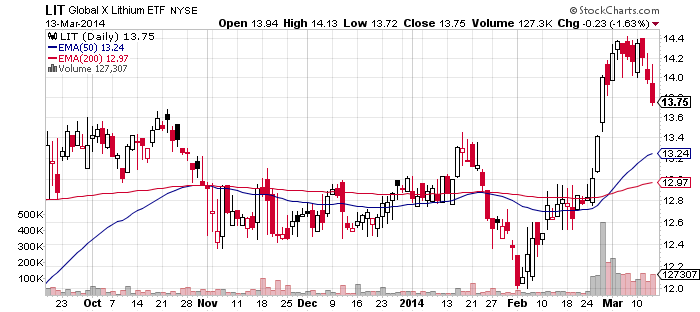

On the daily chart and using exponential moving averages, we can see a positive cross between the 50EMA and the 200EMA, along with a bull flag. These are very positive signs for technical analysts.

Although the price has retraced from the peak of this current spike, we can spot a few entry points here:

Aggressive traders can pick up some of this ETF around the center point of the bull flag (13,40 – 13,60), while more conservative investors could wait for the price to pull back to the 50EMA (13,24).

===

Click here to see more of Daryanani’s work