For the past couple of years market correlation has been in a nose dive and has stayed rather low. What is correlation? Simply put, if stock moves are dictated by market movements then correlation is high, advantage to the index player. When correlation is low then stocks move on their own merit. As a chartist, it really shouldn’t matter – conditions are recognized and we must play accordingly. However, a stock picker would prefer to play in an uncorrelated market, where there is an advantage over the markets.

No surprise, when correlation started to fall so did volatility. In fact, market volatility has only been over 20% a handful of time over the past 15 months. It’s an astounding mark but really not too surprising. Why? The markets hate uncertainty, it brings about fear of the unknown and if you were around in 2011 to trade this market, you understand why.

So, if volatility and correlation dropped then there had to be a reason, right? Yep, it’s the Fed and their reassurances to support the economy and be accommodating to the markets. But is that all it took? No, not quite – a coordinated effort to do ‘something’ around the globe pretty much snuffed out any exogenous threats and surprises.

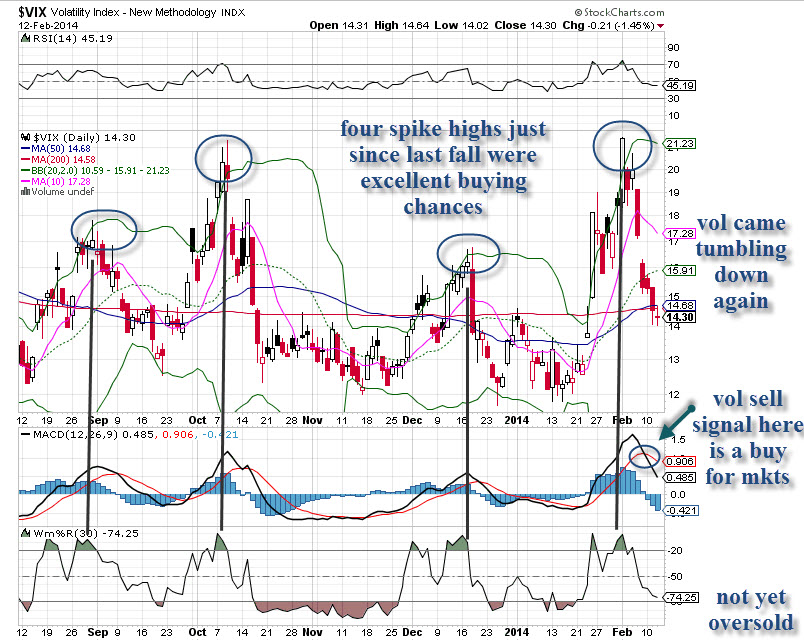

Recent scares from the EM countries, our own political ramblings and worries over potential slowing growth in the US put the fear in players and caused a rise in VIX (volatility index) from 12 to 21. This is a very strong move and it wasn’t overnight, rather it occurred over several days – indicating the fear was building and was not just a ‘one day’ scare.

But as we saw on the last six up moves in volatility the VIX left a big spike high, with volatility to be sold quickly. That was good for markets to move upward quickly and in fact some 75 handles in the SPX since Feb 6 low! An amazing turnaround. Did you catch it, or did you not trust this move? It was just another dip to buy – like the previous five times. As a pattern follower, this is the sort of thing I look for – reliability.

= = =

Bob Lang has been managing private options trading accounts for clients since 2004 and providing subscribers with guidance on trading options for income at Explosive Options since 2011.

RELATED READING

Learn in the ins and outs of Debit Spread in our Options Corner column here.