The farming equipment sector has missed much of the monster rally because of pressure on grain prices and trouble in China. But should we really turn our back on the entire sector?

Take Deere & Company (DE). The stock is up only fractionally for the year. At these sale prices, this American icon could make for an attractive recovery play in the New Year.

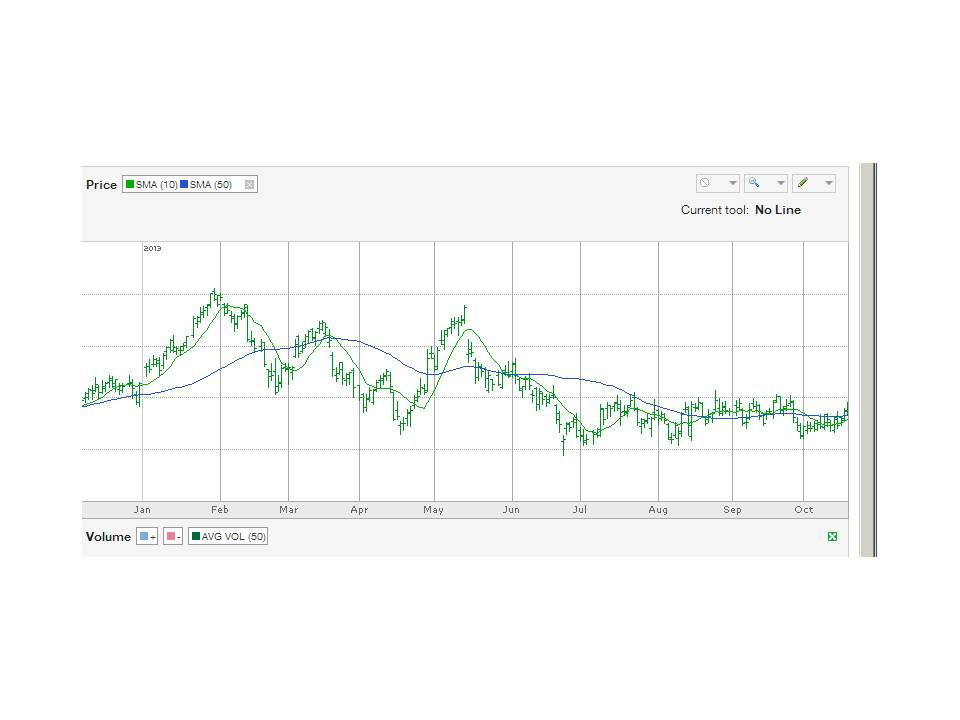

DE has based out with a six-month bottoming channel between $80 and $86 since mid-June. A breakout of the trading range targets a $6 move to $92. That breakout may happen sooner rather than later, as shares are climbing after the company authorized $8 billion in new share repurchases. Only a close below the $80 support level on a weekly basis would negate the basing pattern.

The $92 target is about 8% higher than recent prices, but traders who use a capital-preserving, stock substitution strategy could see a 45% return on a move to that level.

TRADE SETUP

Buy DE June 77.50 Calls at $10 or less

Stop-loss at $5

Initial price target at $14.50 for a potential 45% gain in 6.5 months

This trade breaks even at $87.50 ($77.50 strike plus $10 options premium). That is about $2 away from DE’s recent price. If shares hit the $92 target, then the call option would have $14.50 of intrinsic value and deliver a gain of 45%.

= = =

Learn more about Levin’s educational trading firm here.