I was glad to see Tesla (TSLA) rally 20 points on Tuesday. I didn’t trade it; however, I already own it.

I became a Tesla convert last summer after watching interviews of Elon Musk and test drive videos on YouTube. I gleefully bought some Tesla gear at their showroom in Scottsdale in August and I had a test drive a few weeks ago. It was an experience. Jaw-dropping, really.

For those of you trading Tesla, yesterday’s market action probably inspired some emotion, as well. Emotion (greed or fear) is the enemy of good trading, however. It overwhelms our prefrontal functioning, the place in the brain where good decisions are made.

If you are not trading from your prefrontal zone, you are trading from the brain in your gut. That brain is programmed to chase prey. Gazelles, wildebeests, rabbits, fast moving prices; it really can’t make a distinction.

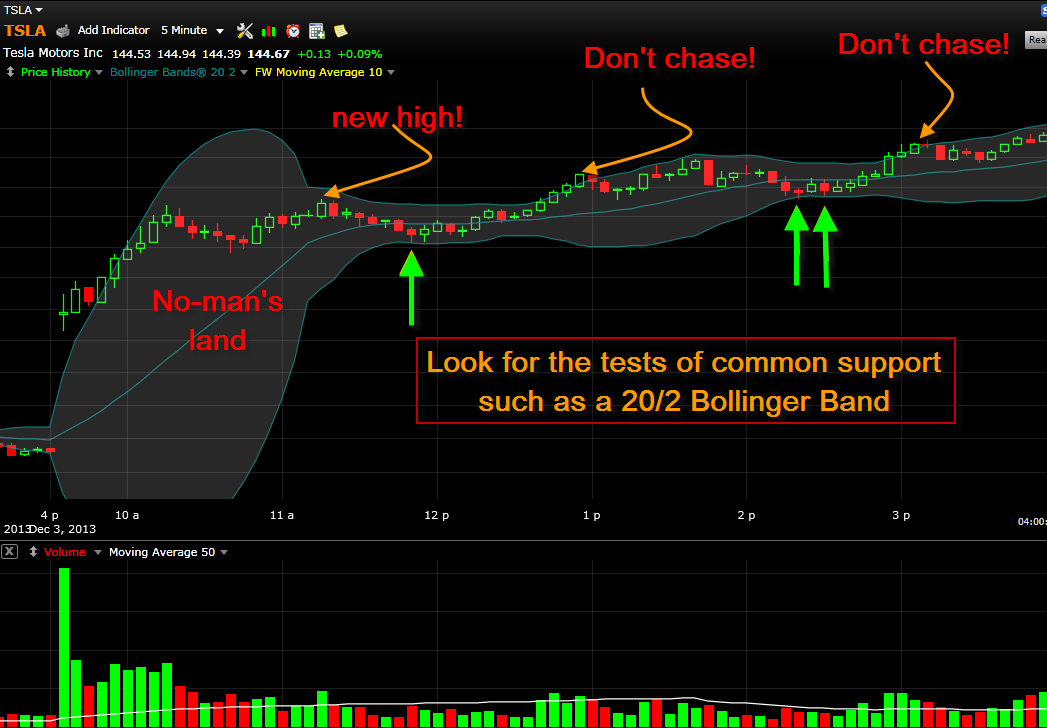

This is a 5-minute chart of TSLA yesterday. During the first two hours, price is in an envelope of volatility that is difficult for most people to trade because it has few technical markers.

In that vacuum of information, raw price action becomes more significant. Did the new high “breakout” candle at 11:15 am ET fool you into chasing it? If so, you had to wait about 90 minutes to get back to breakeven. Chasing (buying high) often puts us on an emotional rollercoaster that makes it more likely we will settle for a breakeven trade and waste an opportunity.

At the end of the day, TSLA closed higher so if you bought high and held you would have been rewarded for bad behavior. That’s unfortunate, because bad habits are eventually costly.

So here’s a tip: When you see a great opportunity in a momentum stock, don’t let yourself get too excited. Wait a few hours until the envelope of volatility has subsided and normal technical indicators apply. Buy at support, if support holds after a test or two. You will have a better chance at fearless profits and the satisfaction of knowing you made an intelligent trade.