In trading forex (or really anything for that matter), the trader must constantly balance what the markets will likely do on their own verses what they will likely do if someone throws a monkey wrench in the works and changes things up. So, one is constantly making decisions under a great deal of uncertainty. And that’s really the nature of the game.

For example, if a company is experiencing a certain rate of growth in their business it’s reasonable for that stock to be reasonably priced based on things like earnings per share and industry strength and presumed security of the investment and a lot of other rather subjective measurements. But, as we so often see, if a company misses projections, or blows past them, we see a corresponding movement in price.

FOREX MARKETS

Well, currencies act the same way except with more subjectivity in the interpretation of their movements. For example, since July, the dollar has lost right around 1,000 pips against the euro and 1,400 pips against the Pound (or roughly 10 and 14 cents respectably for those of us who count in real money). So, absent some change in the world dynamic, it is reasonable to expect this movement to continue.

During this time, good or bad news in U.S. employment or growth didn’t seem to matter a whole lot. In retrospect, the market took the threat of U.S. default about as seriously as I did in my article about the subject.

As we’ve all heard, the markets like to move along the path of least resistance. And that path is generally the same way they had been moving, except when a trend changing event comes along. The problem is, these trend changing events are often hard to predict. The trader must, in effect, guess how much a deviation from current market conditions a certain event will likely move price.

EURO OUTLOOK

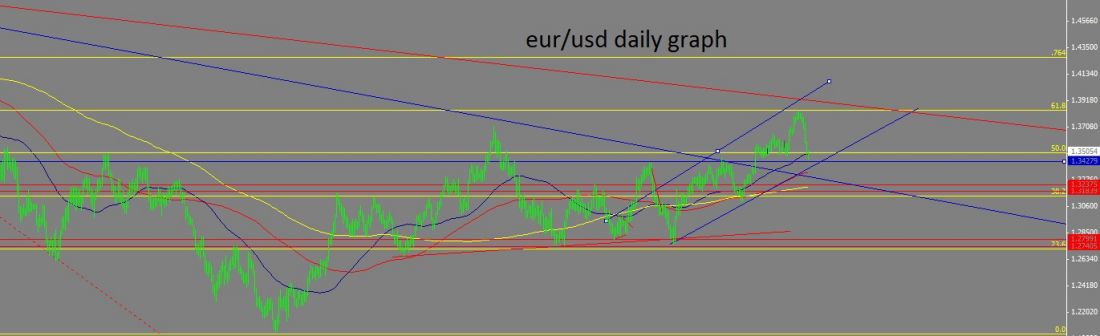

This week, we may see one of those market changing scenarios in the euro. Technically, we hit a fairly strong daily .618 retracement. We are still in an uptrend or a range at best until we convincingly break below about the 1.344 level. The pound gives us a similar pattern, with a potential daily double top, Relative Strength index divergence on the tops. We’ve already seen a trendline break and we are waiting for the bottom to either hold or drop out of the 1.59 area.

For the first part of the week at least, consolidation seems to be the order of the day (or three days). After that, the ECB is going to set the tone. If they decide to take on any number of potential monetary easing options, the reaction will likely be short moves in the euro across the board. On the other hand, if they just talk about it the trader will have to weigh the weight of the words.

And as I’ve talked about above, words can move markets as much as deeds, or not at all.

The difficulty is in the weighing.