So far the market reaction to the government shutdown has been very muted. The broad market indices are down a little – the S&P 500 cash index (SPX) has dropped about five points since the shutdown began October 1 – but it is nothing like the bloodbath we were promised before it all began.

It’s almost as if the market took a look at the shutdown, and decided it had seen this movie before – and knows how it turned out.

EQUITY MARKETS ARE FRAGILE

But that complacency is probably misleading, and the confidence it implies is misplaced. We think the equity markets are much more fragile than they seem, and vulnerable to a sharp decline – regardless of the outcome of the crisis du jour in Washington. To this point the supposed ‘shutdown’ is not even close to a complete shuttering of government offices. “Essential” services are excluded, and the definition of essential is growing with every day.

DEBT CEILING IS CRITICAL

The shutdown is just a sideshow, however. The looming battle over the government’s debt ceiling and the risk of a default on U.S. government obligations has the potential to be much more damaging. Wall Street seems convinced that a debt default will not occur, and it is certainly unlikely. But mistakes happen, and there is a risk the political bungling will result in an “accidental” default. We don’t think that will happen. But the mere possibility is driving the market toward a crisis point. As usual, the chart tells the story.

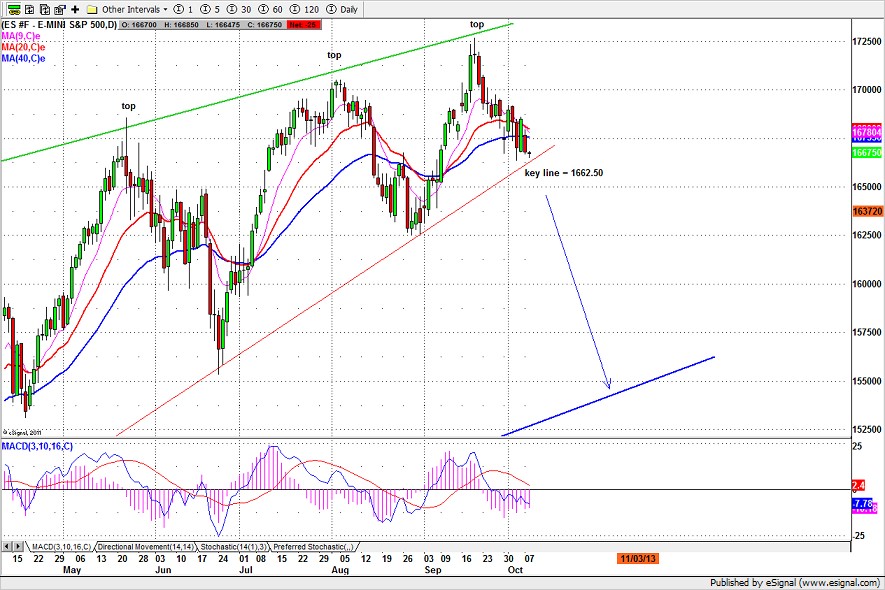

Chart caption: S&P 500 mini futures (ES). Daily chart of Oct. 7, 2013

BUYING DIPS

Until the last few weeks, every decline in the S&P 500 mini futures (ES) has been met by buyers stepping in to “buy the dip.” Some of that money is coming from the Federal Reserve, which is still injecting an average of $4 billion into the various markets every trading day. The Fed buying will continue. The Fed isn’t going to stop pumping money into the markets, but even the Fed has to have somebody to take the other side of the trade. Increasingly, traders are reluctant to do that.

S&P 500 E-MINI AT KEY POINT

As a result, the ES (which is often used as a proxy for the larger market) is now approaching an important decision point, indicated by the thin red line on the chart. That line is the lower boundary of a rising wedge that has supported the price for well over a year. If that support fails to hold this time it will trigger a lot of sell-side stop losses, which will accelerate the price decline. The decision level is around 1662.50. Above that level, the monthly pivot area (1678.50 – 79.50) has been preventing the price from rising.

LOOK OUT BELOW

So there are two conditions: IF 1678.50-79.50 continues to hold the price down; and IF the price falls decisively below 1662.50; THEN we expect a sharp correction headed toward 1600, and perhaps further to 1550. If the decline starts now, the first downside target for us will be 1652.50.

Naturus is the web name of Polly Dampier, who is the brains behind www.naturus.com, a subscription service for active traders.

= = =

Are you trading stocks? Learn a growth investing strategy here. See a step by step buying checklist in this exclusive interview with Bill O’Neil.