On the radio and on the T.V. the gold bugs are still trying to pump gold up. The logic is the fact that gold still has value and that the economy is too week and anemic to allow the dollar to sustain itself.

Unfortunately , the facts speak otherwise.

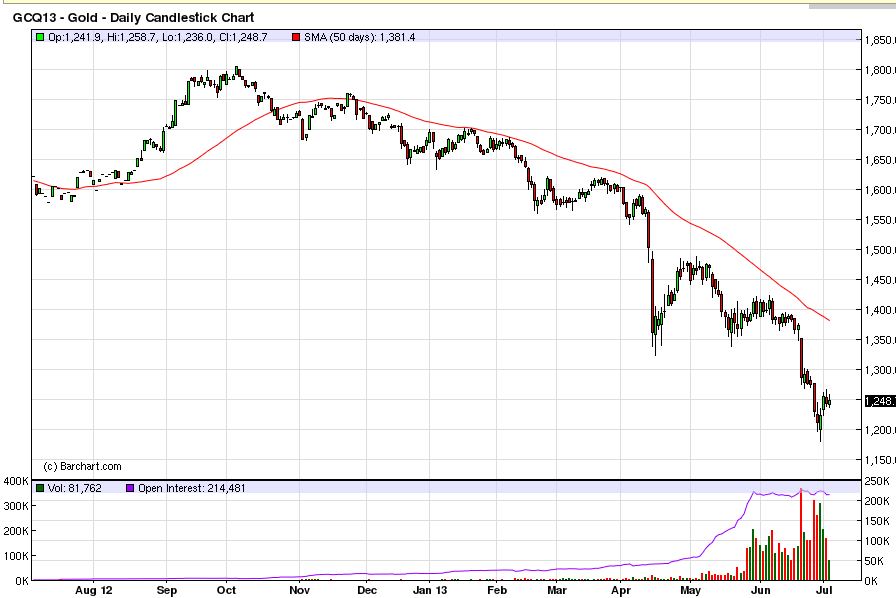

Last summer gold ran from $1,650 to $1,800, reaching super highs, for a metal that was only $300 a little over a decade ago. At the time the sentiment was that gold knew no upper limit I think the term to describe it is “irrational exuberance.” Now that gold has plunged almost $600 in the past year the question remains, what next?

There are two trains of thought. This is simply a decompression in the price of gold, brought on by increased margins against the speculators and a grab for cash due to the weekend stock markets around the world. Those that believe this think that another rally is just right around the corner.

The second train of thought is that gold has made a fundamental shift in price, manipulation or not, we are looking at another decade of gold hovering at this price range of $1200 – $1400 for the next decade. But the problem with both trains of thought is that they both have gold in the equation. The real question is, “Is gold relevant or any other precious metal?”

While gold is setting up for a rally right now, there are a few realities us gold bugs will have to face. First there is no country in the world that will move backwards to a gold standard. There’s not enough gold, financial manipulation, or will power that could sustain any type of pure gold economy.

As long as gold is being bought and traded like any other commodity and not held with some type of archaic reverence gold investors will come out on top, otherwise they are just chasing fool’s gold and are bound to be hurt.