There is a lot of talk about the yellow metal and if the gold bull market is really over or not. However, today we focus on the white metal which is currently showing early signs of a possible major bottom.

On June 10 we saw a modest rally in the silver contract, which came as a surprise after the sharp drop on June 7. This development is actually quite positive as it reveals that there is a supporting trendline in existence from the mid-April panic lows.

TECHNICAL ANALYSIS

Once we’ve plotted the daily chart, we can see that this lower trendline together with the resistance line at the top of the channel is taking the form of a quite strongly converging falling wedge. If you add the significance of the large bull hammer that appeared on the chart in the middle of May, this could be indicating a possible turnaround in the current negative trend.

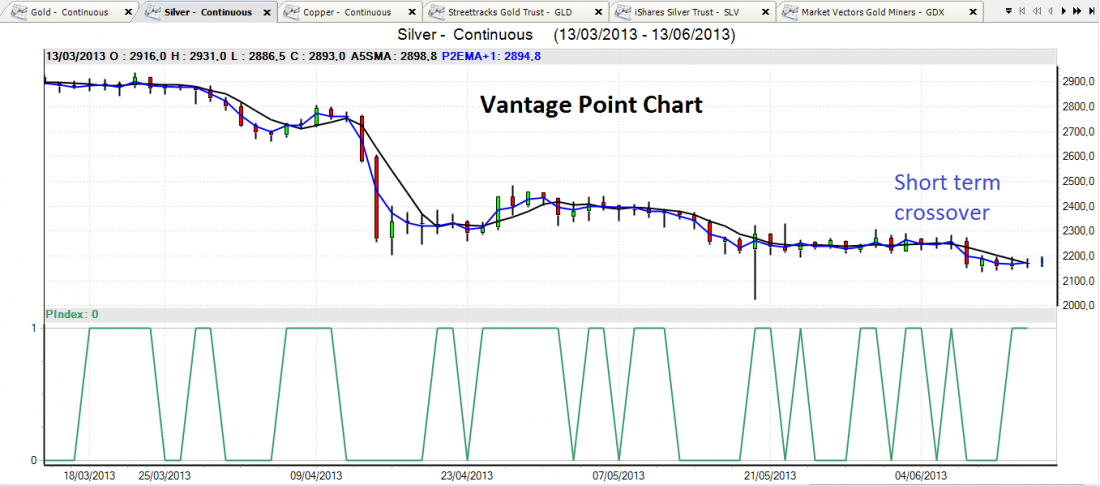

On the Vantage Point chart, we can also see a sign of new strength as the Predicted Short Term Crossover is currently edging above the 5 day simple moving average. This is a bullish sign for silver in the short term. The Predicted Neural Index also points out that the market is expected to move higher over the next few days

BOTTOM LINE

In my opinion, silver is looking better now than most people think as it is very close to an important low. Once this bottom is cleared, we could see the birth of a major new uptrend.

TRADE TO WATCH

Could the sleeping giant wake up after the FOMC’s next meeting on Wednesday?

Should this happen, the recommended ETFs to trade are iShares Silver Trust – SLV (1x) and ProShares Ultra Silver – AGQ (2x).

= = =