Following in the footsteps of SeaWorld (SEAS) and ING, U.S (VOYA), Quintiles Transnational Holdings (Q) is the next large IPO in the pipeline, expected to price its 19.7 million share IPO within a range of $36-$40 on May 10.

Some may recognize the name given its history as a publicly traded company before being taken private in 2008 by TPG and Bain Capital for $3.8 billion. Assuming its IPO were to price at the mid-point of the expected price range, it would command a market cap of $4.87 billion.

CLOSER LOOK AT Q

Q is a formidable company as its business spans across more than 100 countries and it has approximately 27,000 employees.

The company has two primary operating segments, Product Development (74% of FY12 revenue) and Integrated Healthcare Services (26%).

Its Product Development segment is the world’s largest contract research organization (CRO), primarily focused on Phase II-IV clinical trials and associated laboratory and analytical activities. Biopharmaceutical companies, including medical device and diagnostics companies, make up its customer base as those companies look to outsource clinical trials and product development initiatives to Q.

Its Integrated Healthcare Services business primarily serves markets related to the use of approved pharmaceutical products, linking product development to healthcare delivery. More specifically, some of its services include recruiting, training, deploying and managing a sales force, channel management, brand communication, and medical education, among others.

DRUG MAKERS RAMP UP DEVELOPMENT ACTIVITY

While Q isn’t an “up-an-coming” company in the upswing of its growth cycle, it does have some factors working in its favor. For instance, it estimates that total R&D spending in the biopharmaceutical and healthcare industries was $135 billion in 2012 and will grow to $139 billion in 2015.

Aspatents continue to expire over the coming years, major drug manufacturers will be looking to replenish lost revenues with new drug candidates.

Furthermore, many smaller and medium sized companies are having more success tapping the capital markets in order to fund drug development costs. Consequently, more drugs are filtering into the Phase I-III pipeline — 4,028 in 2012, up 18% from 2008 — and Q predicts that further R&D spending will continue to fuel the launch of more drugs going forward.

STABLE AND PROFITABLE, BUT MODERATE GROWTH

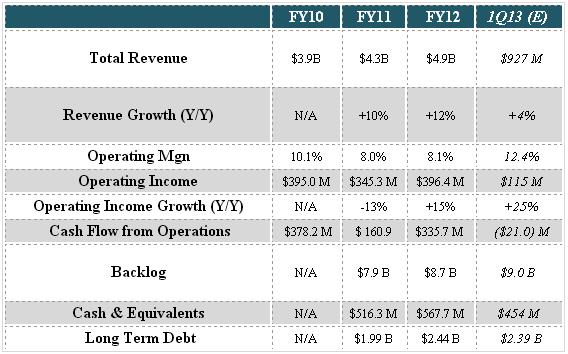

Looking at its financials, In FY12, revenue was up 12% last year to $4.87 billion. Both segments, Product Development and Integrated Healthcare Services, saw a 12% increase in revenue, but on a dollar basis, Product Development was the larger contributor with revenue growing by $291 million.

After slipping by 13% in FY11, Q’s operating income expanded by 15% last year to $396.4 million. However, this is skewed due to a $12.3 million impairment charge taken in FY11 on long-lived assets used in its early clinical development. If this charge were excluded, operating income would’ve only increased by 11% instead of 15%.

Q also provided guidance in its prospectus for 1Q13 with revenue up a modest 4% year/year to $927 million. The Integrated Healthcare Service segment was a drag on the topline as revenue fell by 17% in the period due to lower gross wins and higher cancellations. It attributes this to “current competitive conditions in the marketplace, particularly in Japan and the U.S.”

Still, operating income grew by 25% in the first quarter as its operating margin expanded nicely from FY12 levels.

Q VERSUS PEERS

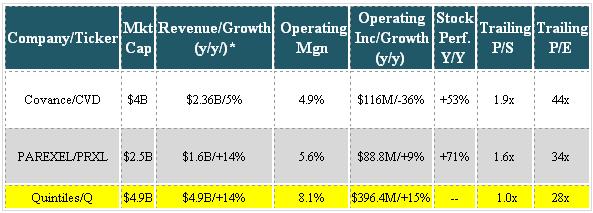

One item that immediately stands out is the stock performance of CVD and PRXL, up 53% and 71%, respectively, year/year. These strong gains certainly bode well for Q’s IPO. There also isn’t an abundance of pure plays in this space to choose from, which is helpful.

Looking at some of Q’s fundamental metrics relative to its competitors, it stacks up quite well. Its revenue growth matches PRXL’s and is well ahead of CVD’s and it also had the highest operating margins in the group.

But not only do its financials look a bit stronger, its valuation is also more attractive than CVD or PRXL.

MIXED FUNDAMENTALS, BUT PROS OUTWEIGH CONS

Q has a market leading position in a stable and growing industry. Clinical trial activity is poised for continued growth and Q should benefit from that.

It is also difficult to ignore the exceptional stock gains over the past year from peers CVD and PRXL. This won’t be lost on prospective buyers of Q who might look to sink some capital into a new investment in this space.

On the other hand, its growth rates aren’t too impressive, especially the +4% in 1Q13. It is concerning that its Integrated Healthcare Services business saw a 17% drop as customers cancelled services and as it won fewer new contracts. Q attributes this to a more challenging competitive environment.

Another potential concern is that backlog at the beginning of the year was heavier on projects in earlier stages of clinical trials. This increases the risk of cancellations as early-stage trials carry higher uncertainty.

To summarize, although we are mixed on Q’s fundamentals, we do think the odds of it generating healthy demand are in its corner.