U.S. non-farm payrolls shocked traders Friday morning with a higher-than-expected reading. Non-farm payrolls rose to a seasonally adjusted 165,000, from 138,000 in the previous month, which figure was revised up from 88,000.

The jobless rate did decline to 7.5% from last month’s 7.6% being the lowest level since December 2008.

The U.S. dollar index has surged higher in early New York action following the report release. Going forward, the key question is: what would be the expected impact on the U.S. dollar index (USDX) after this number? Can the initial bullish move be sustained?

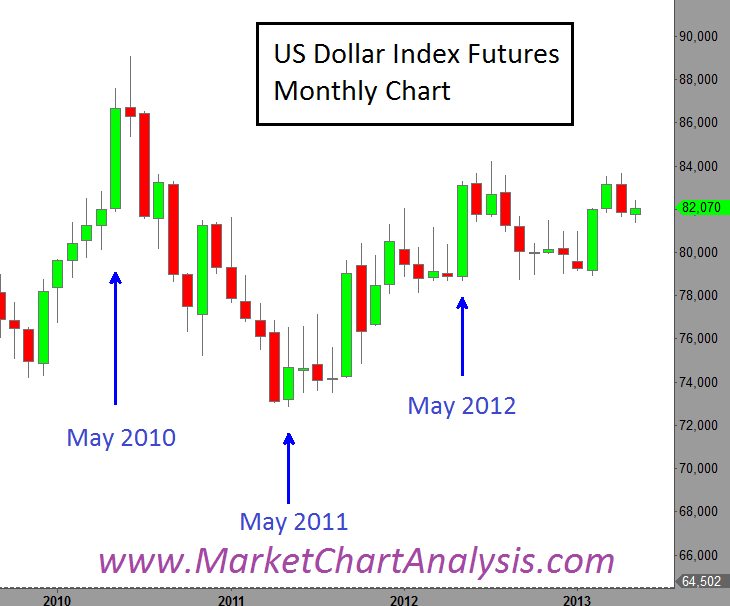

MONTHLY CHART

Can “Sell in May and go away” apply to the U.S. dollar index this year? Not necessarily this time. Looking at the monthly chart of the USDX one can clearly appreciate the fact that during the past three years, the month of May has been good for the greenback.

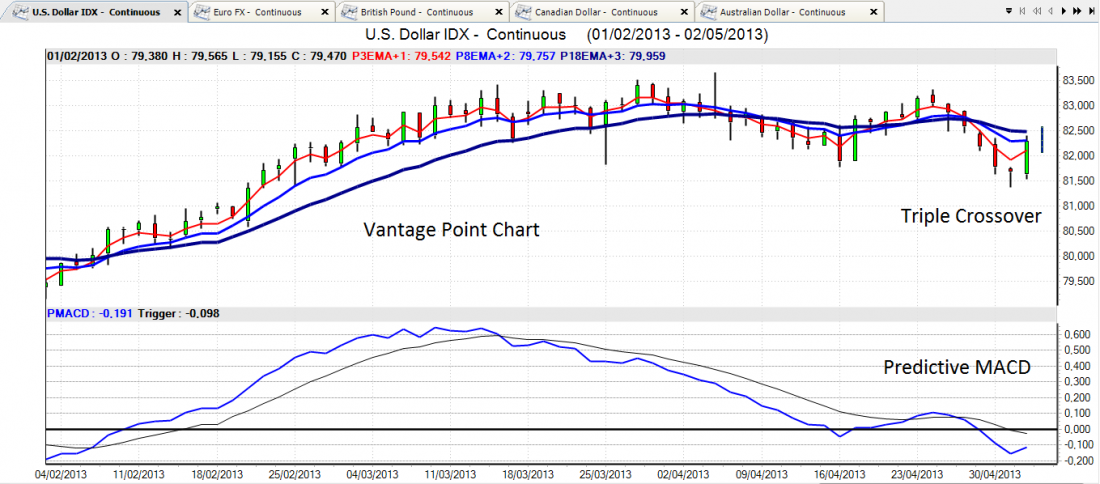

On the Vantage Point chart the underlying sentiment looks bearish, although the Triple crossover and Predictive MACD currently display large divergences that are indicating a possible upcoming bounce.

BOTTOM LINE

If one believes that there is some truth behind the effect of seasonality, then we can expect another good month for May for the U.S. dollar index once again. Perhaps this good reading on the jobs report could fuel the jump in the greenback.

= = =

In order to determine trading levels, one can use powerful indicators like MACD and RSI. Click here to get my complimentary guide 5 Key steps to become a good chartist and learn how to use these indicators and more trading tricks.