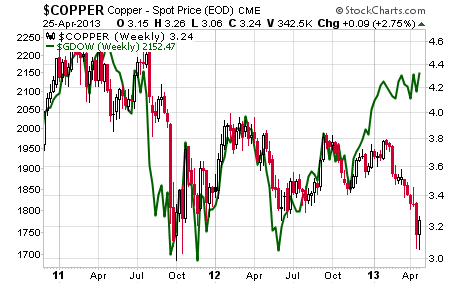

Today we compare the price of the Global Dow ($GDOW) and copper.

GDOW is a 150-stock index of corporations from around the world that includes only blue-chip stocks in the index. These components are weighted equally rather than by price.

The implication here is that price movements of the larger stocks have no greater impact on index performance that those of the smaller stocks.

One of the purposes of the Global Dow is to track leading companies from around the world in all industries, covering both developed and emerging markets. It also includes companies from emerging sectors, such as alternative energy.

There has been a lot of talk recently regarding a sizeable correction of the stock market. Although prices have pulled back a little bit, but not as much as gold and silver, we wonder if a deeper retracement is yet to come in the equity market.

One of the leading indicators that usually anticipates the moves in the stock market has been Copper. This commodity is seen as a gauge for the health of the global economy.

ON THE CHART

On the weekly chart we can see a clear correlation between GDOW and Copper these past few years. However, this has changed since January of this year. While the Global Dow keeps rising, the price of copper has experienced an important pullback, testing deep support levels.

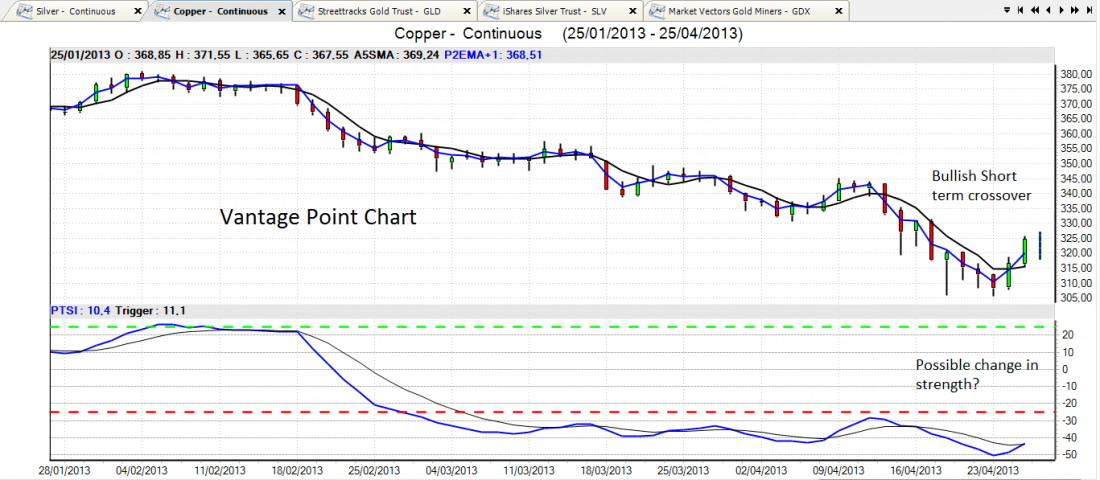

On the Vantage Point chart we can see recent early signs of a possible turnaround in the price of copper with a bullish short term crossover and a possible change in the True Strength Index.

RUPTURE IN CORRELATION

If we believe that copper has the power to anticipate the movements of the stock market, then we might see a possible upcoming pullback. For this to happen, copper futures should also continue dropping and not bounce from here.

However, should this key commodity bottom at these levels, there will be a better chance to see further upswings in the S&P500 and the Dow Jones industrial average, that might attempt to break the 1.600 and 15.000 levels respectively.