EUR/USD

The Euro was initially blocked in the 1.23 area against the dollar on Friday as trading volatility increased. The Bundesbank stated that it remained opposed to bond purchases which dampened enthusiasm following Draghi’s comments the previous day, although the bank did state that there would be no problems with EFSF buying. There was also opposition to the ESM being granted a banking licence.

There was a renewed flurry of comments from Euro-zone officials which contributed to further volatility during the New York session. German Chancellor Merkel and French President Hollande stated that it would do everything necessary to keep the Euro intact. There were expectations that the ECB would push for a further cut in interest rates and an additional LTRO as well as bond buying

The German Finance Minister also welcomed Draghi’s comments and there was a further sharp decline in Spanish bond yields during the day which helped stem immediate fears surrounding the Spanish outlook. There was also a decline in Italian yields at the latest bill auction which helped improve sentiment. There were also reports that the ECB could move to accepting a haircut on Greek bond holdings in order to ease the debt burden.

There were, however, still very serious concerns surrounding the underlying Spanish outlook as unemployment increased to 24.6% for the second quarter while there was still underlying speculation surrounding the underlying economic outlook.

The second-quarter US GDP data was marginally stronger than expected at 1.5% from a revised 2.1% previously. There was a slowdown in consumer spending and weaker than expected investment levels which maintained unease over the outlook. There was further speculation that the Federal Reserve could move towards additional quantitative easing at this week’s FOMC meeting.

The Euro pushed to highs around 1.2380 before retreating very sharply on fears that ECB action would also push the Euro weaker. There was consolidation around 1.23 in Asia on Monday with expectations of further short covering helping to lessen underlying Euro selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 78.10 region against the yen on Friday and pushed higher during the US session. Although the US GDP data was hardly inspiring, there was relief that it was not even worse than expected and there reduced expectations that the Federal Reserve would move to additional quantitative easing at the August meeting.

The latest Japanese industrial production data was weaker than expected with a 0.1% decline for June compared with expectations of a 1.6% increase which reinforced unease over domestic and regional growth trends.

There was a report of a government strategy plan to avoid a vicious cycle of deflation which will reinforce expectations of fresh Bank of Japan intervention to prevent yen appreciation. The dollar was unable to hold above the 78.50 level on Monday as global doubts persisted.

Sterling

Sterling found support below 1.57 against the dollar on Friday and hit a 35-week high in the 1.5760 region. The UK currency was subjected to choppy trading with sharp moves on the crosses as the Euro attempted to move above 0.7850 before weakening again.

Standard & Poor’s confirmed the UK AAA credit rating with a stable outlook with expectations that there would be a recovery in growth during the second half of 2012, but there was a clear hint that the view could be changed if the growth outlook fails to improve.

There was also additional speculation that the Bank of England could move to cut interest rates later in 2012 which would increase the potential for Sterling to be used as a global funding currency. Hometrack recorded a marginal decline in house prices for June, the first reduction for the year, as Sterling retreated back towards the 1.5720 area in Asia on Monday.

Swiss franc

The dollar dipped to lows close to 0.97 against the franc on Friday before recovering back to the 0.9750 region. There were no moves in the Euro as it remained trapped close to 1.2010.

Any aggressive measures to support the Euro-zone through additional monetary action would undermine Euro yield support, although the impact would be offset by the fact that there could be reduced fears surrounding the structural outlook which could alleviate pressure.

The Swiss KOF index was stronger than expected with a move to 1.43 from 1.15 the previous month which eased economic fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

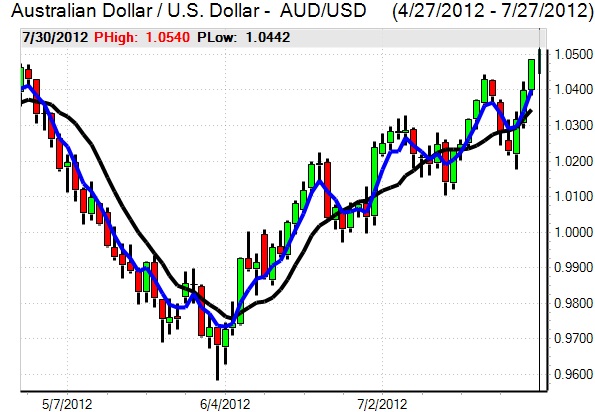

Australian dollar

The Australian dollar found support in the 1.04 region and pushed to a high around 1.0480. There were further expectations of aggressive central bank action to boost global demand which helped underpin the currency as the US dollar was generally weaker.

The currency was unable to make further headway on Monday with the weaker Japanese industrial data reinforcing global uncertainty as commodity prices were generally weaker. There was a small increase in home sales according to the latest HIA data which helped underpin sentiment slightly.