Mmmmmmm, these charts are looking good!

Mmmmmmm, these charts are looking good!

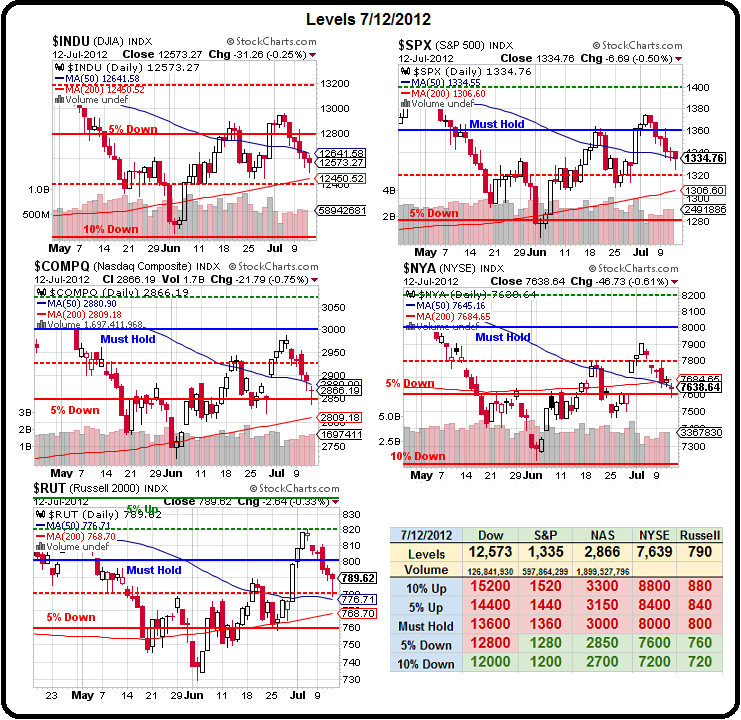

Well, good for those of us who played for those “M” patterns to form last week, anyway. As I said on Monday, when we predicted the exact patten you can clearly see forming on the Big Chart, we had flipped bearish right at the tippy-top last Tuesday, ahead of the July 4th break, because the run-up seemed fake, Fake, FAKE – just more low-volume, manipulated BS on bad news that lead to the anticipation of more QE.

As we expected, this week we got more bad news and still no QE – how could we possibly go up on that?

I also mentioned on Monday that we had taken some bearish plays for this week that were highlighted in Stock World Weekly (page one, in fact), including the SQQQ July $47s, which opened Monday at $1.85, dropped to $1.55 that day and as low as $1.10 on Tuesday but finished the day yesterday at $4.10 after topping out at $5.25 – up 126% from Monday’s open.

The more conservative AMZN Oct $185 puts finished the day at $5.10 yesterday and that’s up 34% in 5 days in a market that’s down 5% – this is a good way to offset bullish bets, isn’t it?

The third trade featured on Stock World Weekly’s first page (you can subscribe by clicking here), which I also reiterated in Monday’s post, was EDZ, which jumped from $14 to $16.21 this week (up 15.7%) and our more aggressive option play on that was the Aug $14/18 bull call spread at $1.20, selling the Aug $14 puts for $1 for net .,20 on the $4 spread. As of yesterday’s close, the Aug $14 puts had dropped to .50 and the bull spread had jumped to $1.60 for net $1.10, up .90 on the .20 cash investment for a 450% gain in a week. That too, can offset quite a bit of a 5% drop in the market without committing very much of your portfolio’s cash to a hedge.

That’s why we can look at this very ugly chart and say “wheeeeee” – it’s fun to have hedges!

That’s why we can look at this very ugly chart and say “wheeeeee” – it’s fun to have hedges!

We talked all about the “M” patterns and our expectations for the indices on Tuesday and on Wednesday I said we have to wait until the end of next week to see if those 200 dmas hold up but it’s possible…