Hollande won the French election.

Hollande won the French election.

In a sharp rebuke of the Merkozy austerity programs, the French went with the guy who promises to tax the rich and the CAC has rallied 2% off it’s low open as of 8am – indicating that the “bad” news in the French election was more than baked into the underperformance of the French market recently. This is a “sell on the rumor, buy on the news” event – kind of like the 100% rally the US markets had after we elected that notorious Socialist, Barack Obama.

As you can see from Dave Fry’s chart of last week’s action in France, the EWQ dropped 3.5% in aniticapation of the Hollande victory so we’re not going to be too impressed by a 0.7% bounce that retraces 20% of the drop or even a 1.75% bounce, that retraces half the drop – if that’s all there is.

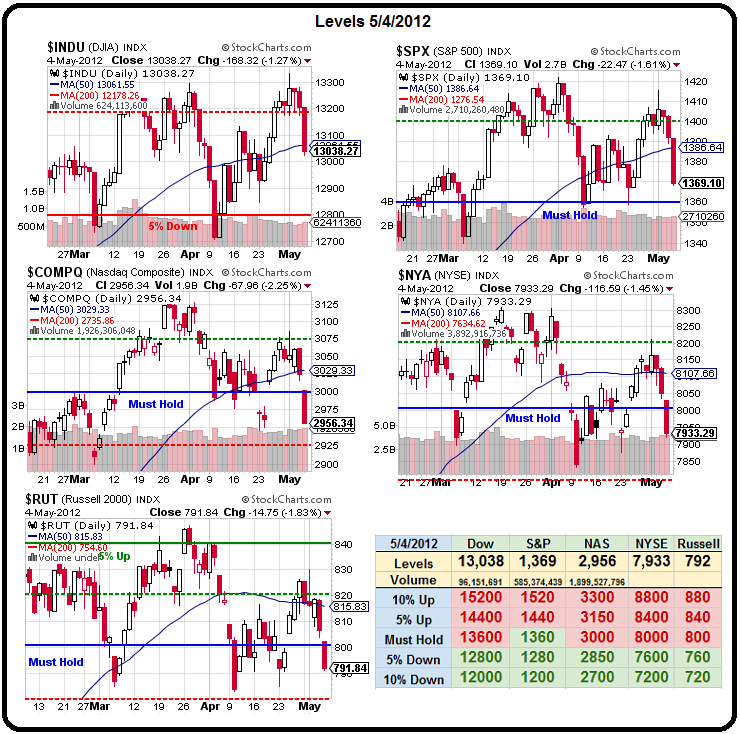

None of the structural issues that affect the EU are going away so we’ll just have to dig a little deeper this week and try to get to the bottom of what’s really driving the International Markets so get ready for a lot of Global Macro talk as we watch our own Big Chart levels to see what sticks and what doesn’t as we test those Much Hold levels to — well to see if they hold, of course!

None of the structural issues that affect the EU are going away so we’ll just have to dig a little deeper this week and try to get to the bottom of what’s really driving the International Markets so get ready for a lot of Global Macro talk as we watch our own Big Chart levels to see what sticks and what doesn’t as we test those Much Hold levels to — well to see if they hold, of course!

S&P 500 futures gapped down 1% at the open following Hollande’s victory in France and a poor showing by Pasok and New Democracy in Greece (regional elections in Germany didn’t go Merkel’s way either). German Dax futures were -1.3% (now -.5%) and France’s CAC 40 -1.5% (now +0.5%). The euro gaps down 70 pips to $1.3009 vs. the greenback, and ?0.8059 vs. sterling, the lowest level since late 2008.

Exit polls in Greece show the 2 pro-bailout parties garnering just 32% of the vote, maybe not enough to form a majority government. It’s a shocking fall for Pasok and New Democracy, which together claimed nearly 80% of the vote in 2009. “The exit polls confirm … there’s no political consensus for the kind of reforms Greece must implement if it wants to remain in the eurozone,” says Nicholas Spiro. This is not something that will be resolved quickly, as long as the future of the Euro is in quesiton – we are…