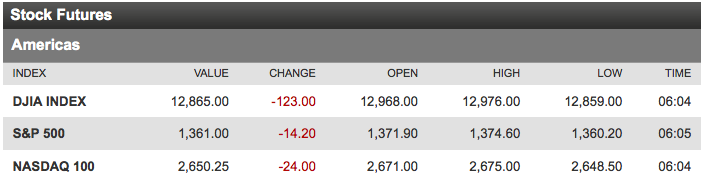

ow THIS looks a little more realistic, doesn’t it?

ow THIS looks a little more realistic, doesn’t it?

Last Monday we pointed out that the run-up, that was coming DESPITE a myriad of Fundamental negatives we were tracking, was essentially a load of crap aimed at bringing in more suckers before they pull the rug out from under the market. To keep ourselves from getting sucked in by the hype, we drew some very simple lines across our mult-chart which were 50% retacements of the month’s dip. Not making those lines during last week’s actions kept us from making poor decisions as the market hype continued all week. My warning was:

“How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer?”

Tuesday I got a lot of sheeple angry by calling them sheeple for falling for Cramer and the rest of the Mainstream Media hype and we discussed a few of our hedges that were working already, like TZA, TLT and SQQQ as well as two that were still playable: CAT May $95 puts at $1.10 – up just 15% from our initial entry and DXD May $12 calls at $1.35, up just 12% from when our Members got the Trade Idea. Despite the market moving up, I reiterated my sell-off targets of Russell 775 and S&P 1,325.

Wednesday we tried to find reasons to be bullish, presenting both sides but judgment was once again for the bears after weighing the evidence as I pointed out that the lack of economic improvement for the bottom 90% could not be ignored – something Nick Sarkozy just discovered this weekend. In the morning post, I mentioned going back to the well and shorting oil again as it dared to reach for $104.50 again – another lovely pay-off last week and we caught it again this morning at $103.50 (/CL Futures) for a quick $500 per contract – so far.

Thursday we were having great fun and we had a bullish spread on CHK at $17.20 that may still be playable this week as the market dips again. We discussed our goal of re-shorting PCLN (back in the July $560 puts at $8.50) and we added a nice CMG spread in the morning post, selling the May $475 calls for…