By FXEmpire.com

EUR/USD Fundamental Analysis April 23, 2012, Forecast

Analysis and Recommendations:

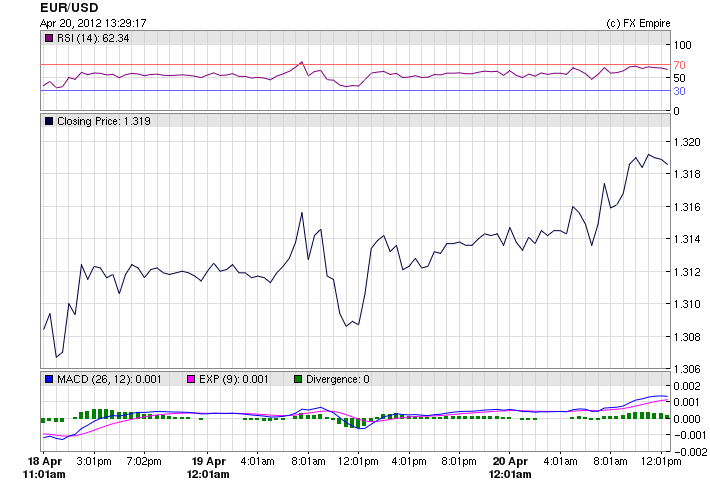

The EUR/USD surprised speculators today, climbing back over the 1.32 level to trade as high as 1.3224 and settling in at 1.3217. The euro picked up momentum of the German Business Confidence report along with several other leading indicators that gave a boost the currency.

The Munich-based Ifo Institute’s German business confidence index rose to 109.9 in April from a reading of 109.8 in March, data showed Friday. Economists had forecast a decline to 109.5. Europe is expecting Germany to lead the EU out of the recession.

Across the Atlantic investors are starting to worry about the US economic recovery, as rising layoffs, falling home sales and slowing manufacturing activity are sparking fears that the economic recovery is headed for a springtime stall for the third year in a row.

There was little in the way of news or other eco data ending the week.

Economic Data for April 20, 2012 actual v. forecast

|

JPY |

Tertiary Industry Activity Index (MoM) |

0.0% |

0.8% |

-0.6% |

|

AUD |

Import Price Index (QoQ) |

-1.2% |

-1.0% |

2.5% |

|

EUR |

German PPI (MoM) |

0.6% |

0.4% |

0.4% |

|

EUR |

German PPI (YoY) |

3.3% |

3.1% |

3.2% |

|

EUR |

German Ifo Business Climate Index |

109.9 |

109.5 |

109.8 |

|

EUR |

German Current Assessment |

117.5 |

117.0 |

117.4 |

|

EUR |

German Business Expectations |

102.7 |

102.5 |

102.7 |

|

GBP |

Retail Sales (MoM) |

1.8% |

0.5% |

-0.8% |

|

GBP |

Retail Sales (YoY) |

3.3% |

1.4% |

1.0% |

|

Core CPI (MoM) |

0.3% |

0.4% |

||

|

CAD |

CPI (MoM) |

0.4% |

1.0% |

0.4% |

|

CAD |

Leading Indicators (MoM) |

0.4% |

1.0% |

0.7% |

|

CAD |

CPI (YoY) |

1.9% |

2.0% |

2.6% |

|

MXN |

Mexican Unemployment Rate |

4.6% |

4.9% |

5.3% |

Economic Events scheduled for April 23, 2012 that affect the European and American Markets

06:00:00 GBP Nationwide Housing Prices n.s.a (YoY) -0.90%

The Nationwide Housing Prices shows the value of the houses prices in UK and indicate current movements in the housing market that is considered as a sensitive factor to the UK’s economy. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

06:00:00 GBP Nationwide Housing Prices s.a (MoM) -1%

The Nationwide Housing Prices shows the value of the houses prices in UK and indicate current movements in the housing market that is considered as a sensitive factor to the UK’s economy. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

07:28:00 EUR Purchasing Manager Index Manufacturing 48.4

The Manufacturing Purchasing Managers Index (PMI) released by the Markit economics captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the manufacturing PMI is an important indicator of business conditions and the overall economic condition in Germany. Normally, a result above 50 signals is bullish for the EUR, whereas a result below 50 is seen as bearish.

07:28:00 EUR Purchasing Manager Index Services 52.1

The Services PMI released by the Markit Economics interviews German executives on the status of sales, employment, and their outlook. Because the performance of the German service sector is extremely consistent over time, services does not impact final GDP figures as much as the more volatile figure on the manufacturing sector. Any reading above 50 signals expansion, while a reading under 50 shows contraction.

Government Bond Auctions (this week)

Apr 23-27 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication (further details tba)

Apr 23 09:30 Germany Eur 3.0bn new Apr 2013 (12M) Bubill

Apr 23 10:00 Belgium OLO Auction cancelled

Apr 23 15:30 Italy Details BTP/CCTeu on Apr 27

Apr 24 00:30 Japan Auctions 20Y JGBs

Apr 24 08:30 Holland Eur 1.5-2.5bn Jul 2014 & Jan 2037 DSL auction

Apr 24 08:30 Spain 3 & 6M T-bill auction

Apr 24 09:10 Italy Auctions CTZ/BTPei

Apr 24 14:30 UK Details Conventional Gilt auction on May 01 & I/L auction on May 03

Apr 24 17:00 US Auctions 2Y Notes

Apr 25 09:10 Sweden Auctions T-bills

Apr 25 09:30 Germany Eur 3.0bn new Jul 2044 Bund

Apr 25 14:30 Sweden Details nominal bond auction on May 02

Apr 25 17:00 US Auctions 5Y Notes

Apr 26 00:30 Japan Auctions 2Y JGBs

Click here a current EUR/USD Chart.

Originally posted here