By FXEmpire.com

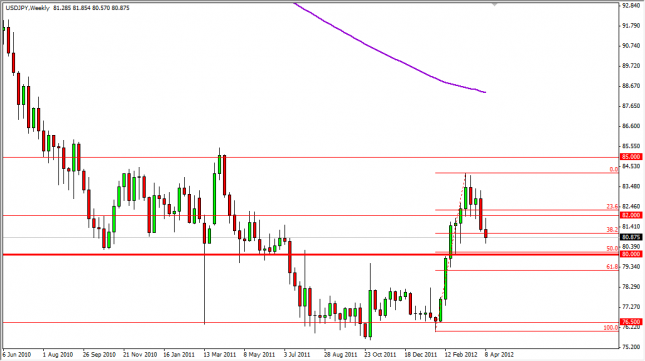

The USD/JPY pair fell again this past week, but is rapidly approaching serious support levels. The 80 handle has long been one of the most interesting areas in this pair, and it was also the site of a massive breakout recently. The area had even stood up to two Bank of Japan interventions before finally giving way in February.

The Bank of Japan has expanded the asset buying program it uses to help control interest rates in that country, and as a result has essentially started “printing Yen.” This will work against the Yen all things being equal, and as long as the Federal Reserve suggests that it isn’t quite ready to ease more, this will be bullish for this pair. However, the latest statements out of the Fed haven’t been as clear as the trading world would like.

The candle for the session is bearish, but is almost more of a stalemate as it looks somewhat flat. The range was good for the week, but the area that we are approaching should start to see more buyers step into the markets as the move up will have been missed by a lot of people that didn’t initially believe that the pair was breaking out back in February.

The 80 handle hasn’t really been retested since the breakout, so this will be vital for the future of this pair. If the 80 level can keep the bears at bay, we could begin to see a shift in the trend for the longer-term in this pair in which it will start to appreciate. The action has been choppy, but this is quite common for trend changes, and especially so for the Yen in general. (One only needs to look at the trend change in ’95 to see a great example.)

As a result, we are ready to buy supportive candles down at the 80 level, on the daily, weekly, or whatever. We will manage this trade with the weekly chart. A break above the 85 handle has this pair really accelerating to the upside, but this could take some real time as the markets try to figure out what to do.

USD/JPY Forecast for the Week of April 16, 2012, Technical Analysis

Originally posted here