By FXEmpire.com

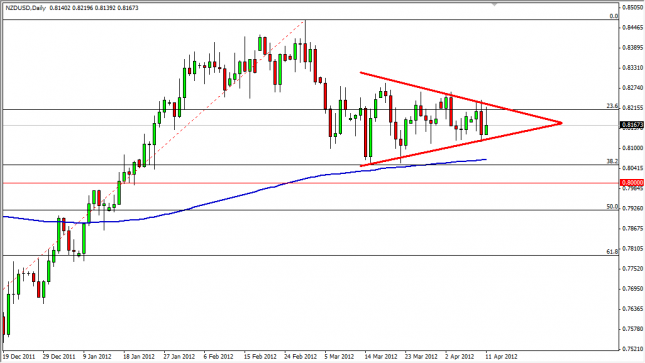

The NZD/USD pair rose during the Wednesday session, but was hardly impressive in doing so. Sure, the original push was strong, but it gave up quite a bit of its gains for the session in order to form a shooting star. Not only did it form this bearish looking candle, but it also fell right into what is looking more and more like a wedge forming.

The pair is risk sensitive, and with the selloff we saw on Tuesday, it is possible that we are getting ready to see more risk aversion in the financial markets going forward. The market in this pair is always a bit whippy as it is less liquid than many of the others, but it is also a favorite for the exact same reason. After all, when the commodity markets gain, this pair normally outperforms the Aussie and Loonie. With this in mind, it is always an important one to keep an eye on the pair.

The triangle and candle are a bit worrisome, but it must be said that the 200 day EMA is just under the triangle, and the shape is symmetrical – so it could be positive as well. The 0.80 level just below is also going to be supportive as it is a large round number. The 0.80 level is also wedged between the 38.2 and 50% Fibonacci levels too, so this should be a “super support level”. Because of this, weakness may fade, but one cannot help but to notice that the pair is one that could be a great barometer for all other assets, and this is why we are paying such close attention to it.

As for trading it, the buying of this pair is an easy signal to figure out – a daily close above the top line of the triangle becomes our buy signal. This would jive well with the trend overall, and would also signal that many commodity markets and risk related currencies should do well. However, if we get a breakdown in this pair, it may not necessarily be a sell signal in it per se, but rather a statement in general about risk appetite, and should signal Dollar buying on the whole.

NZD/USD Forecast April 12, 2012, Technical Analysis

Originally posted here