By FXEmpire.com

EUR/GBP Fundamental Analysis April 11, 2012, Forecast

Analysis and Recommendations:

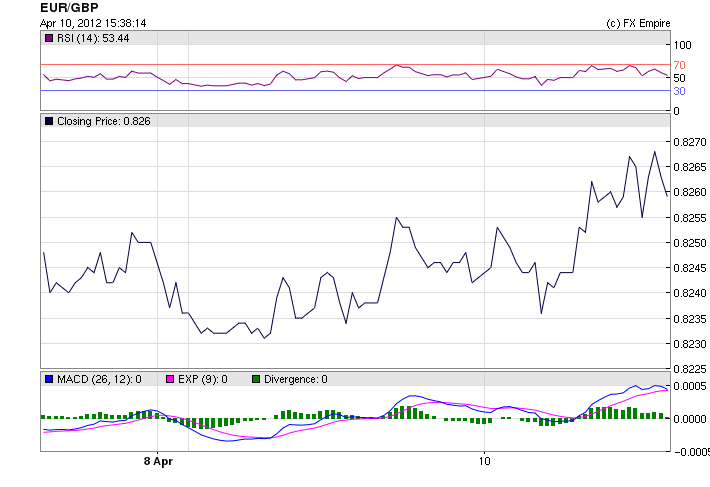

The EUR/GBP is priced at 0.8250 almost at the opening for today. The pair opened at 0.8248 after the long holiday weekend. Early in the session the euro was trading stronger topping out at 0.8276. It was not long before investors began to lose confidence and worries of Spain and Italy began to weigh on the euro. Investors moved quickly in the afternoon to safer assets, pushing gold, the greenback and the yen upwards.

Yields on Spanish and Italian government bond yields continued to rise on Tuesday as financial markets in Europe reopened after a four-day Easter break. Yields on 10-year Spanish government bonds jumped 9 basis points to 5.83%.

More and more news began to surface questioning the limits of the EU firewall, just recently approved by the Finance Ministers.

This week has a thin economics calendar with no events to help support either, so it will be a week of news, and rumor.

Economic Data for April 10, 2012 actual v. forecast

|

GBP |

RICS House Price Balance |

-10% |

-12% |

-13% |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

AUD |

NAB Business Confidence |

3 |

1 |

|

|

CNY |

Chinese Trade Balance |

5.3B |

-1.3B |

-31.5B |

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

CHF |

Unemployment Rate |

3.1% |

3.1% |

3.1% |

|

DKK |

Danish CPI (YoY) |

2.70% |

2.70% |

2.80% |

|

JPY |

BoJ Press Conference |

|||

|

NOK |

Norwegian Core Inflation (MoM) |

0.40% |

0.30% |

0.70% |

|

NOK |

Norwegian CPI (MoM) |

-0.10% |

-0.10% |

1.00% |

Economic Events for April, 11, 2012

02:30 AUD Home Loans (MoM) -3.5% -1.2%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

13:15 CAD Housing Starts 200K 201K

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

13:30 USD Import Price Index (MoM) 0.8% 0.4%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

19:00 USD Federal Budget Balance -201.5B -232.0B

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auctions April 10-20, 2012

Apr 11 09:10 Italy BOT auction

Apr 11 09:30 Germany Eur 5.0bn new Jul 2022 Bund

Apr 11 09:10 Sweden Sek 5.0bn Jul 2012 & Sek 5.0bn Sep 2012 T-bills

Apr 11 09:30 Swiss Bond auction

Apr 11 09:30 UK Gbp 4.5bn 1.0% Sep 2017 Conventional Gilt

Apr 11 10:00 Norway Details T-bill auction on Apr 16

Apr 11 14:30 Sweden Details nominal bond auction on Apr 18

Apr 11 17:00 US Auctions 10Y Notes

Apr 12 09:10 Italy BTP/CCTeu auction

Apr 12 09:30 UK Gbp 2.0bn 4.25% Jun 2032 Conventional Gilt

Apr 12 15:00 US Announces auction of 5Y TIPS on Apr 19

Apr 12 17:00 US Auctions 30Y Bonds

Apr 13 10:00 Belgium OLO mini bond auction

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:

Originally posted here